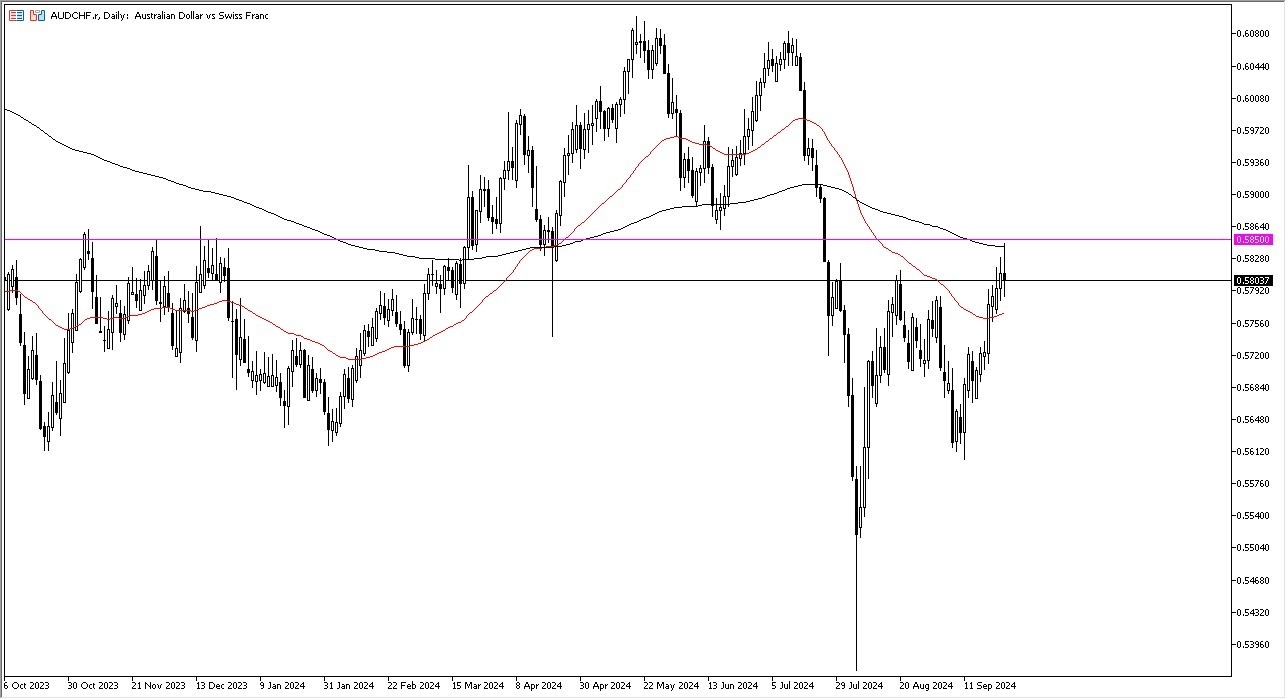

- The AUD/CHF pair has seen a lot of noisy behavior, as we had reached the 200 Day EMA, which of course is an indicator that a lot of people pay close attention to, we ended up turning around and pulling back to form a bit of a shooting star.

- All things being equal, this is a market that I think continues to see a lot of noisy trading overall, which does make a lot of sense considering that this pair is highly speculative under the best of circumstances, and of course this is a market that is very shaky to say the least.

Technical Analysis

The technical analysis of course is somewhat mixed for this pair, and I expect that to be the case as the Swiss franc is considered to be a safety currency, and the Australian dollar of course has the veneer of a market that is likely to continue to look for risk appetite to go higher. I believe that the 0.5850 level is an area that you need to pay close attention to, and if we can break above that for a daily close, then I think the market could go much higher.

Top Forex Brokers

It’s also worth noting that we are currently between the 200 Day EMA and the 50 Day EMA, which of course makes a lot of noisy behavior. Technical traders will pay close attention to this area, but if we were to break down below the 50 Day EMA, the market could very well find itself dropping down to the 0.57 level. This is an area that obviously is a large, round, psychologically significant figure, and an area where we have seen buyers previously.

All things being equal, you will have to pay close attention to risk appetite around the world to see what happens in this pair. More likely than not, I would be a buyer of this pair on a breakout to the upside, and as far as selling is concerned, I don’t necessarily want to do so quite yet, due to the fact that the market has a lot of previous noise in the area just below.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.