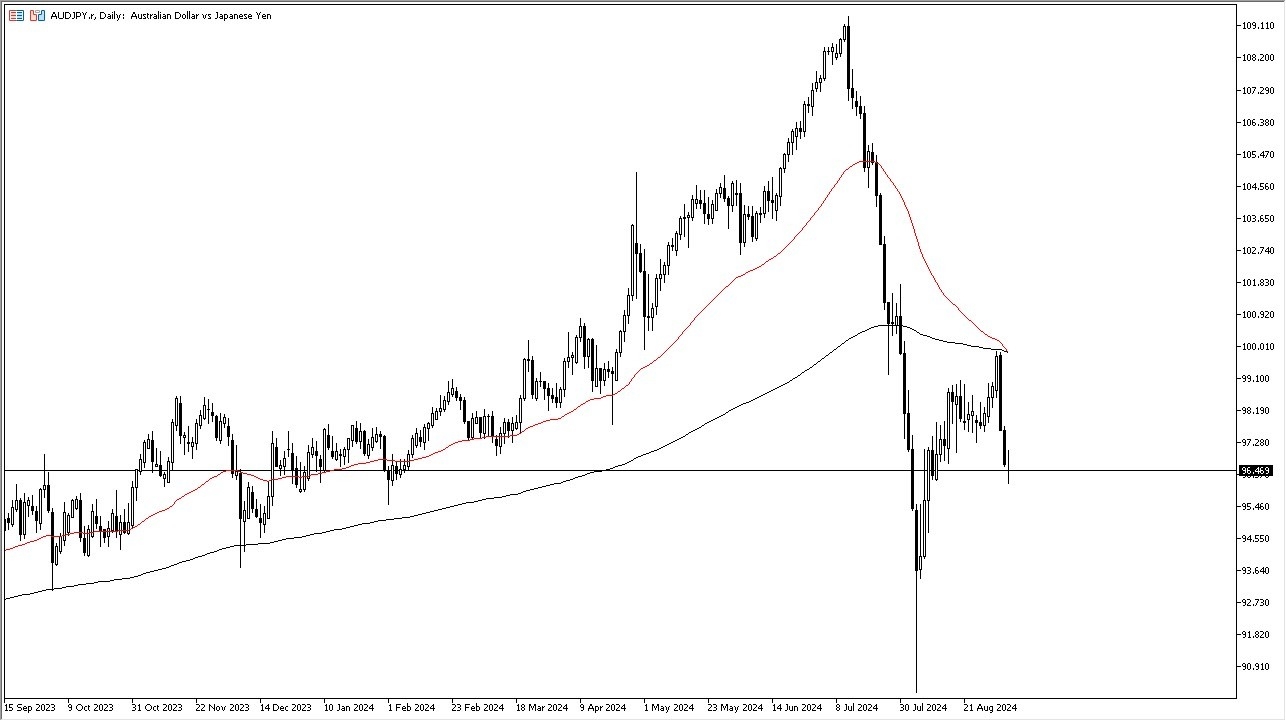

- The Aussie dollar went back and forth during the course of the trading session on Thursday as we continue to look for some type of support.

- All things being equal, this is a market that I think is going to be paying close attention to the risk appetite of traders around the world because the Japanese yen is considered to be a major safety currency, while the Australian dollar is certainly a risk on type of currency.

- Recently, we've seen the Japanese yen strength due to the idea that the Bank of Japan is going to continue to tighten monetary policy.

With this being the case, the market has been getting rid of the carry trade. So going forward, we'll have to pay close attention because the Bank of Japan does have a significant interest rate decision coming. At this point in time, the Japanese are at a state of flux because their economy can't handle high interest rates.

Top Forex Brokers

Can Japan Pulls This Off Alone?

So, without some type of coordination with other central banks, it'll be interesting to see just how far they can go. Nonetheless, there's more of a risk off type of attitude around the world right now. We're seeing that played out in all of the yen denominated pairs. If we break down from here, an area of extreme interest will be the 95 yen level. If we break down below that level, it could continue this pair much lower. On a rally, the 100 yen level is a bit of a ceiling, but anything above there probably sends money flying right back into the carry trade.

Ultimately, this is a pair that we need to watch other markets around the world in order to get a gauge on what risk appetite is going to be, and if we see money flying into the stock market, that could help this pair, but I think most people will be waiting to see what the Bank of Japan does in 2 weeks when it has its interest rate decision.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.