Potential Signal:

- Keep in mind that I want to trade in the same direction the risk appetite is going.

- I will watch the DAX, FTSE 100, ASX 200, and NASDAQ 100 to get a read on where risk appetite is going.

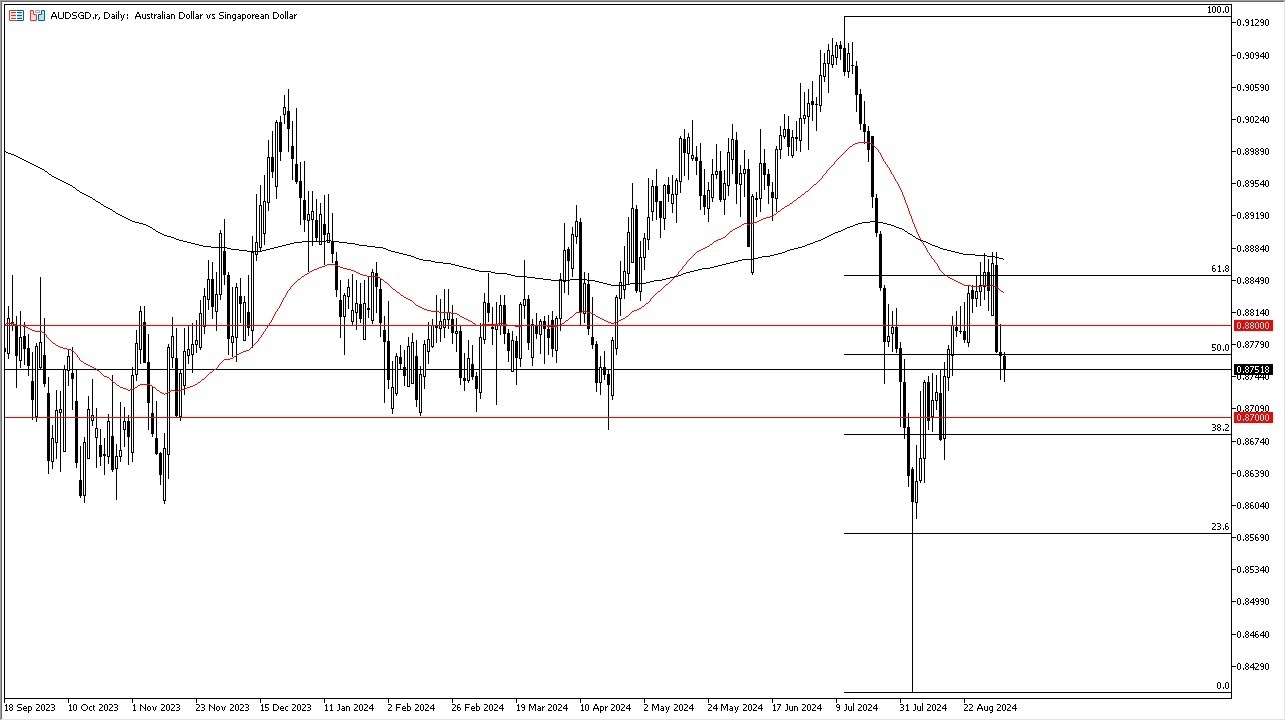

- If they are all rising at the same time, in this pair breaks the 0.88 level, then I will be a buyer with a stop loss at the 0.8750 level, and a target of 0.90 above.

- On the other hand, if those indices are all falling in this pair breaks below the 0.87 level, then I am going short with a target of 0.86 and a stop loss of 0.88 above.

In my daily analysis of exotic currency pairs, the Australian dollar/Singapore dollar currency pair has been of interest to me. The market seems as if it is an area that is rather important, because we are at a situation where there could be a bit of cross currents.

Top Forex Brokers

Ultimately, the market is one that is highly sensitive to risk appetite, with the Australian dollar being a currency that traders run to when there is a lot of risk appetite out there, while the Singapore dollar is considered to be more or less a safety currency for Asian traders. Because of this, it gives you a good read as to what the risk appetite is in general in that part of the world.

Technical Analysis

At this point in time, the market is at a major point of inflection due to the fact that the 0.88 level is an area that has shown itself to be both support and resistance in the past. Because of this, I think there’s a certain amount of market memory that could come into the market at that point. That being said, it’s also worth noting that we had initially tried to rally and break above the 200-Day EMA just a few days ago but failed quite drastically.

You will notice on the chart that I also have the 0.87 level underneath offering support, and if we break down below there then I think the market truly starts to fall apart. That being said, this is not a market you tend to trade in and of itself, which you look for is the overall attitude of markets including global indices in the stock market give you a bit of an idea as to which one of these currencies you want to own. If indices around the world start to fall drastically, then I will short this market as soon as it breaks down below the 0.87 level. On the other hand, if we get some type of recovery, then I will go long at the 0.88 level.

Want to trade our daily forex analysis and predictions? Here's the best forex brokers in Singapore to check out.