- The Australian dollar rallied slightly during Wednesday’s session, but traders are now focused on the upcoming FOMC statement, interest rate decision, and, most importantly, Jerome Powell’s press conference.

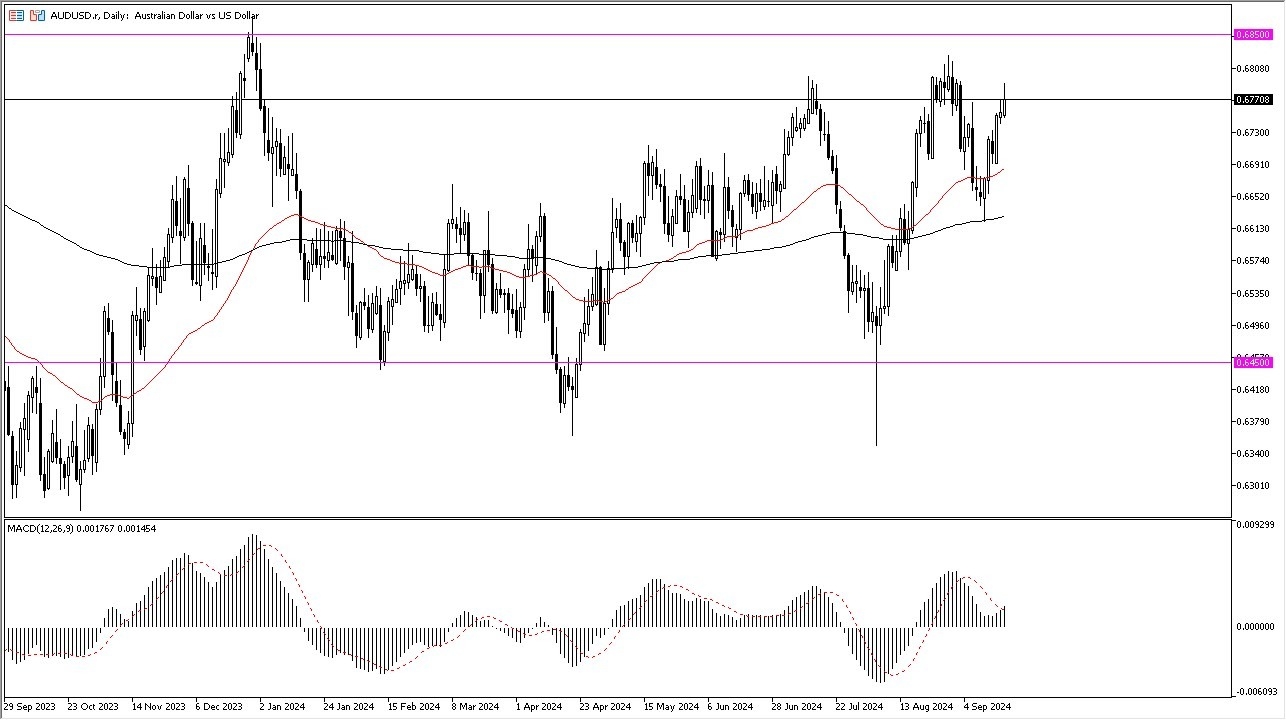

- Because of this, I would be very cautious about trading in this market, but you can make an argument that perhaps this 0.6850 level is the real level that everybody should be watching.

- If we can get above there, then I think the Aussie takes off, but you will more likely than not have to see what happens with the US dollar against everything else.

A Plethora of Reasons for Movement

There are a lot of different scenarios at the moment that could come into play, but let's suggest that perhaps the Fed cuts 25 basis points. Then the next question is going to be, will they continue to cut? There is also growing interest in trading betting that the Fed is going to cut 50 basis points. If that is in fact the case, it's possible that you may see the dollar strengthen.

Top Forex Brokers

The reason I say that is it could be seen as a sign of panic that the Fed is behind the curve. Here's a hint. Anytime there is an economic slowdown, the federal reserve is behind the curve. That doesn't mean it happens during the session today. It just means that sooner or later you will see some type of risk off move. In the short term, I do believe that the 0.6, 8, 5, 0 level is crucial to watch for bullish signals.

But if we pull back, the 50-day EMA sits right around the 0.67 level. That probably offers a little bit of support. This is a market that tends to grind and go back and forth, and I think we'll probably see more of that.

Ready to trade our AUD/USD Forex forecast? Here’s some of the top forex online trading Australia to check out