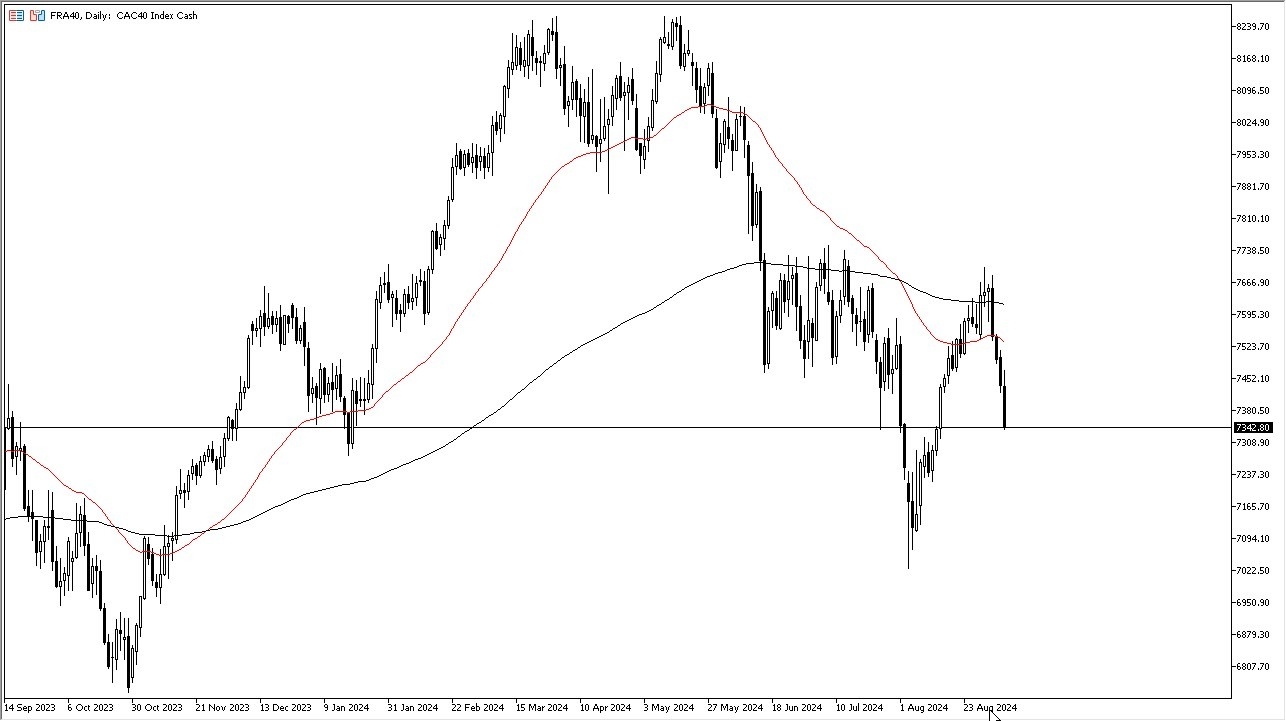

- During the early hours on Friday, we initially saw the market try to rally only to turn around and fall rather significantly in Paris.

- The CAC 40 has been falling for a while and Friday was just more of the same.

- This is a market that has been negative for some time, as the risk appetite continues to fall drastically.

- With this, I think this is a situation where it is very difficult to get long, as the Parisian index continues to focus on the global economy.

With that being said, the market is likely to continue dropping from here because it looks like something has now broken. Short term rallies will almost certainly attract sellers given enough time, especially near the 50 day EMA which is just above the 7,525 euro level. Anything above there could open up the possibility of a move to the 200 day EMA, but I wouldn't hold my breath for this. The market is more likely than not to be able to do so. Ultimately, this is a market that lacks overall strength, and I think will continue to do so.

Top Forex Brokers

On the Downside

We could get going to get looking to the 7200 euro level and then perhaps the 7100 euro level. Keep in mind that Paris is highly sensitive to the idea of expensive luxury exports, so if America is struggling, they're not going to be buying French luxury items. The rest of the European Union certainly already is struggling, so you start to run into problems, especially as China is cooling off. So that's most of France's customers.

With that being said all the political turmoil in France at any given moment, the CAC may not necessarily be the first place people are looking to invest in. I do believe this market continues to go lower, although we could get a short term balance in the meantime, which I think will only be looked at as a better entry for a short position.

Start trading the daily stock market analysis. Get our recommended Forex brokers for CFD trading here.