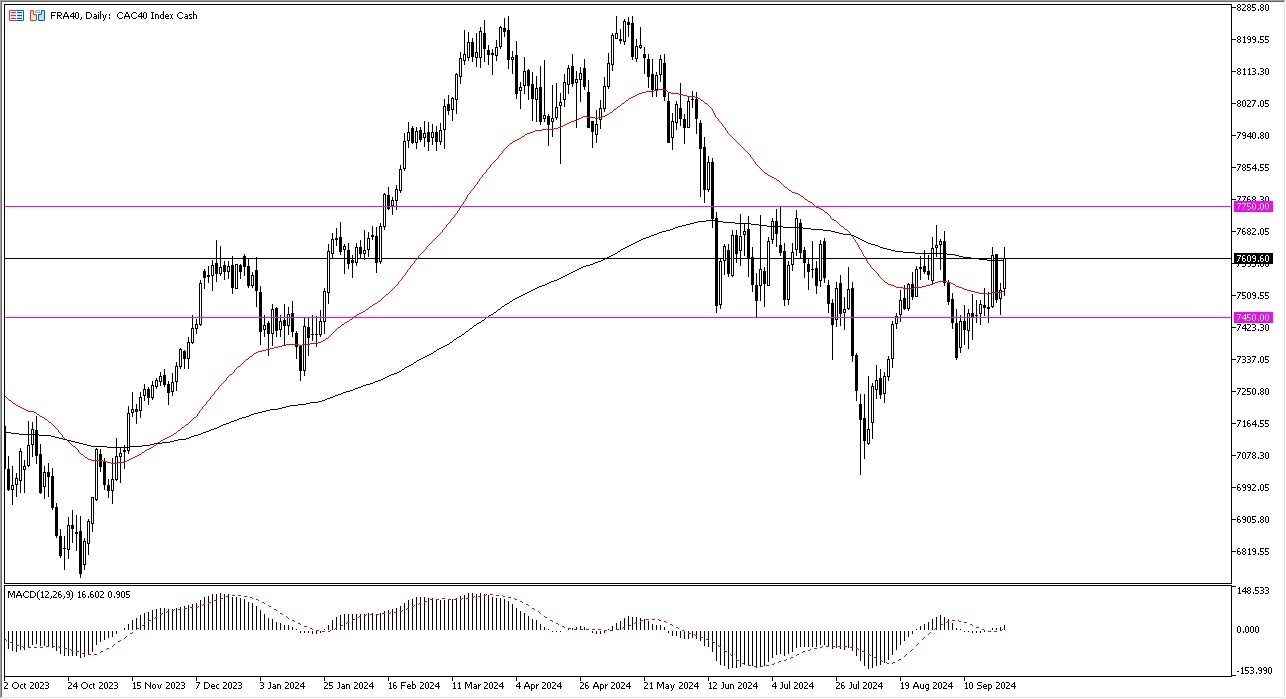

- The Paris index was rather bullish during the trading session, testing the 200 day EMA near the 7,600 euro level.

- All things being equal, if the market could continue to go higher, then we could see the CAC 40 reach the 7,750 euros level.

- Short-term pullbacks at this point in time will more likely than not be buying opportunities with the 50 day EMA at the bottom of the daily candle on Tuesday, offering support.

A breakdown below there then tests the 7,450 euro level, which of course is an area that a lot of people will be watching. In general, this is a scenario where it looks like we are in the midst of trying to form some type of weird, inverted head and shoulders. And that of course is a somewhat bullish sign.

Top Forex Brokers

On a Rally

That being said, if you continue to rally from here, the 7,750 euro level being broken is the true sign that Paris is about to take off to the upside. Keep in mind that there's a lot of risk appetite questions out there with the Federal Reserve cutting rates and of course the ECB doing the same thing. It suggests that perhaps people will pile into the stock market in order to try to make some type of money based on the idea of liquidity issues.

Looking at this chart, a short-term pullback probably offers plenty of opportunity, but if we were to break down below the 7,450 euro level, then the 7,340 euro level would be a support level, and then after that we could go down to the 7,100 euro level. Keep in mind that the CAC 40 will continue to be a follower, if you will, of the DAX circumstances so watch Germany as well. Keep in mind that the European Union tends to move in the same direction overall, and the fact that Paris has the second-largest index is something worth keeping in the back of your mind.

Ready to trade our daily stock market forecast? Here are the best CFD brokers to choose from.