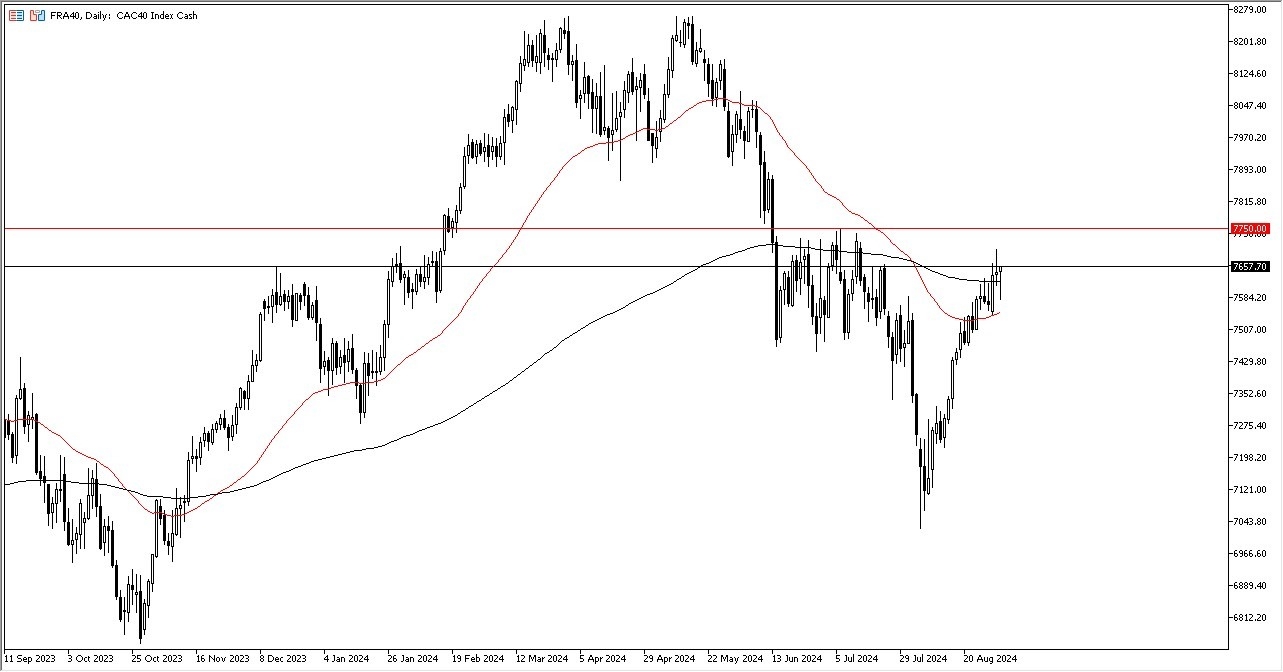

- The Parisian CAC 40 pulled back just a bit to show signs of weakness initially during the trading session on Monday, but then turned around to bounce back above the 200 day EMA.

- At this point in time, it's worth noting that the Friday candlestick was a shooting star, and that of course shows hesitation.

- Above there, we have a lot of resistance near the 7,750 euros level, an area that is not only somewhat of a psychologically important figure, but it's also an area where we've seen a lot of action previously.

If we could break above there, then I think the CAC 40 goes much higher. In the short term, we could very well see a lot of back and forth. And therefore, I think you have a range bound market just waiting to happen, but I still think it favors the upside overall.

Top Forex Brokers

Technical Analysis

The 50 day EMA underneath looks like it is offering support. And of course, we have the 7,500 level offering a bit of a floor. All things being equal, this is a market that is likely to be very noisy, and probably be closely following the ECB and what their monetary policy is. While we know that they have loosened a bit here recently, we are in a major inflection zone. So therefore, if we get above the 7,750 euro level, I really think that not only the CAC in Paris will take off, but I think quite a few other indices in the European Union are going to do much of the same. On the other hand, if we were to break down below the 7,500 euro level, then I think you probably see indices across the continent start to fall in unison.

At this point, the stock markets are all going to move in unison, as the market is going to see a lot of from around the world. This is a situation where if we see a lot of selling in New York, Pairs will not be spared, as traders look at this as yet another part of the global financial system.

Ready to trade our daily analysis & predictions? Here are the best CFD brokers to choose from.