- During my daily analysis of minor currency pairs, the CAD/CHF pair has caught a certain amount of attention on my part.

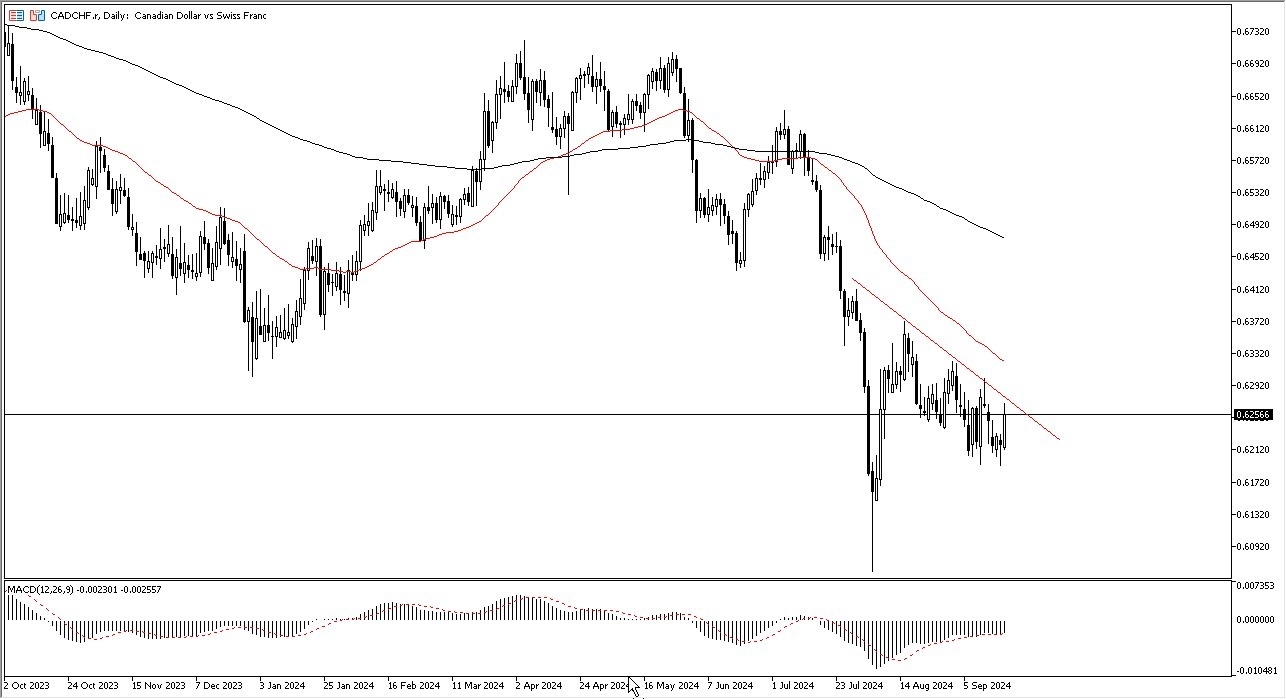

- The market is likely to continue to pay close attention to the trendline that we have been following for several months, and therefore the trendline being respected is not a big surprise.

- If we can break above the top of the downtrend line, then the market could go looking to the 50 Day EMA after that.

Looking at this chart, you also have to keep in mind that this is a market that is highly influenced by risk appetite, as the Canadian dollar is highly sensitive to the crude oil markets, as well as overall global growth due to the fact that the crude oil markets are highly sensitive to whether or not we are growing or shrinking. The size of the candlestick is rather impressive, and therefore it looks like it’s more of a “risk on market” during the trading session on Thursday. On the other hand, if we were to turn around and start falling, then it shows that there is a certain amount of risk aversion coming back into the picture, as the Swiss franc is considered to be a major safety currency. In other words, people start to get concerned about the overall global market, then the Swiss franc should attract a certain amount of attention.

Top Forex Brokers

Overall Global Economic Activity

If to keep in mind that the overall global economic activity could be a major issue, because the crude oil market of course is trying to recover, but it also has an uphill battle against almost everything due to the fact that the market is trying to figure out whether or not we have demand picking up due to the fact that the economic activity should pick up, or if we are going to see global stagnation, which of course would be very negative for crude oil. Ultimately, this is a “risk on/risk off” set up at this point.

If we were to break down below the 0.62 level, that would be a very negative turn of events, and it would probably see the Swiss franc strengthening against almost everything. On the other hand, if we can break above the 50 Day EMA, the Canadian dollar more likely than not will go looking to the 200 Day EMA.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.