- The Canadian dollar has been very volatile against the Swiss franc, and I think that will continue to be something that you need to pay attention to.

- This is because this is a risk appetite based currency pair, meaning that the Canadian dollar strengthens if there is more risk being taken on out there, while the Swiss franc strengthens due to risk aversion as it is considered to be a safety currency.

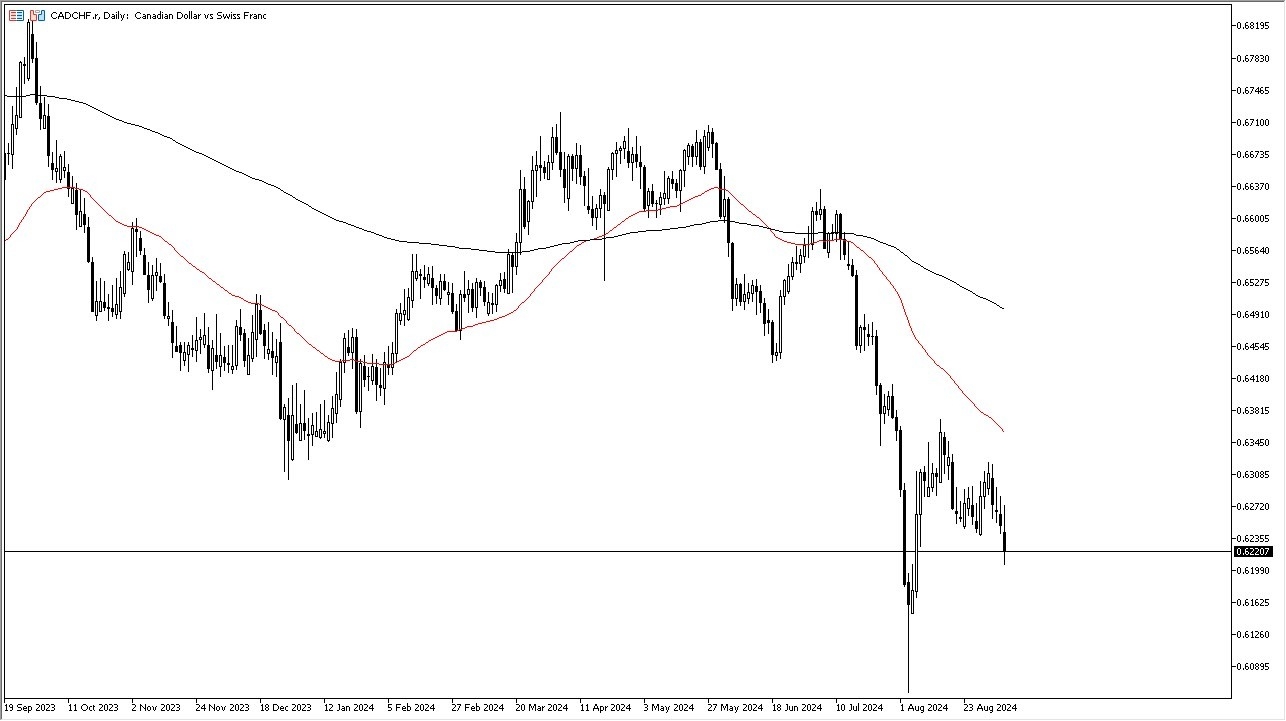

The market has been in a downtrend for some time, and therefore I think you need to recognize the fact of falling during the Friday session of course is something that makes a certain amount of sense. It makes a certain amount of sense also that the Canadian dollar has struggled as the unemployment rate inched up to the 6.6% level, and the gain in jobs in Canada was just 22,100 jobs added for the previous month, lower than the expected 23,700.

Top Forex Brokers

Furthermore, you also have to keep in mind that the crude oil market has been plunging and of course the Canadian dollar is a proxy for the crude oil market, and therefore the fact that it is losing strength means that traders believe that the crude oil market will probably continue to see a lot of negativity due to that. That being said, this is a market that has been so far sold off that it looks like we are seeing a fresh new leg of negativity.

Technical Analysis

The technical analysis of course looks very negative for this market, and after the Friday session looks even worse. At this point I would not be surprised at all to see this market go looking to the 0.6150 level, an area that previously had been supported. It’s also worth noting that the 50 Day EMA is an indicator that currently sits right around the 0.6350 level and is dropping, and probably will offer a certain amount of resistance on any attempt to rally anyway. With that being said, you would need to see other markets out there start to show more “risk off behavior” for this pair to start rallying again.

Not sure which broker to choose? We've made a list of the best forex brokers for you.