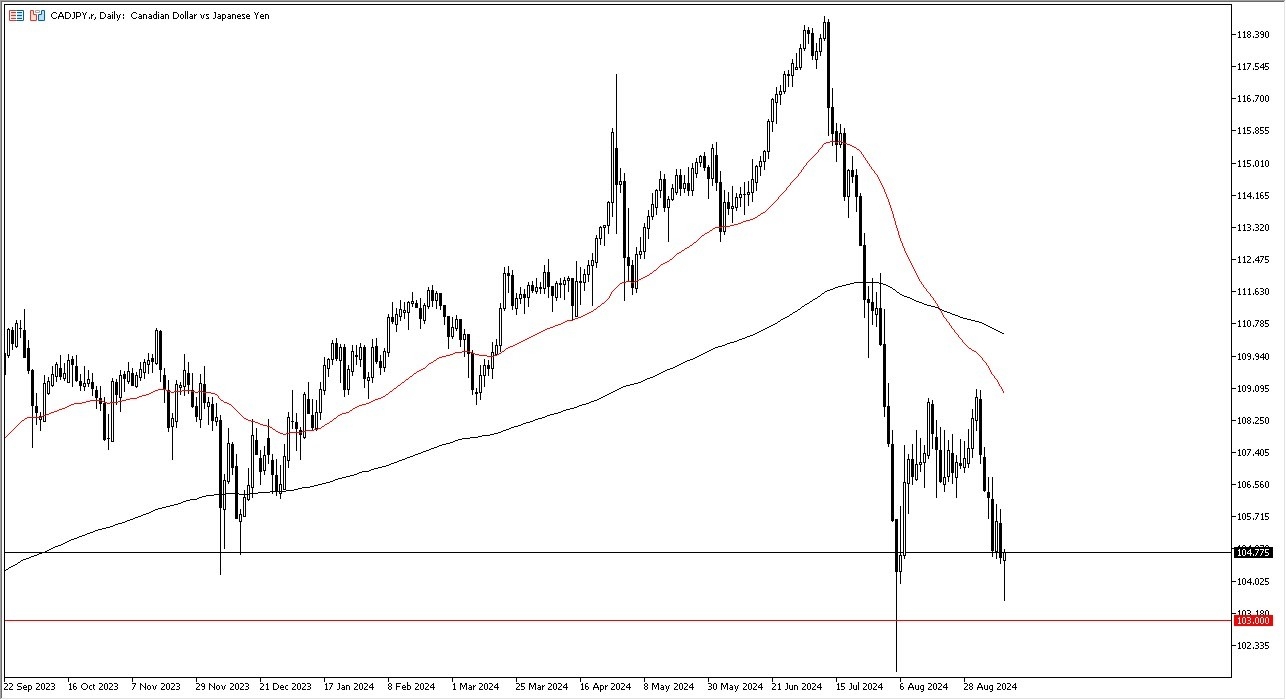

- The Canadian dollar initially pulled back just a bit during the trading session on Wednesday against the Japanese yen only to turn around and show signs of life.

- Ultimately, I think this is a situation where people are looking at the 103 yen level as a potential floor in the market.

- It will be interesting to see if that ends up holding up.

- All things being equal, this is a market that I think continues to look at the oil market as a potential driver.

- This is a market that also has to keep in mind that the risk appetite has been all over the place.

The Japanese yen is being a significant safety currency, while the Canadian dollar focuses more on commodities, specifically oil. In general, this is a market that I think will continue to end up being very noisy, but I also recognize that if we do rally from here, we could go all the way to the 109 yen level and still be in overall consolidation.

Top Forex Brokers

Can We Break Higher Now?

So, with that being said, I do think we are in the process of perhaps trying to form a double bottom. I like the idea of buying a position once we break a little bit higher and perhaps trying to dip my toe in the water. I don't necessarily like the idea of trying to get too cute here.

I think we've got a scenario where the market has to hang on to the 103 yen level, because if it were to break below there, then it's likely that the market really starts to fall apart. With this being said, I am cautiously optimistic, at least for a short-term trade, and then I recognize that once we get to the 109 yen level, the real fight begins.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.