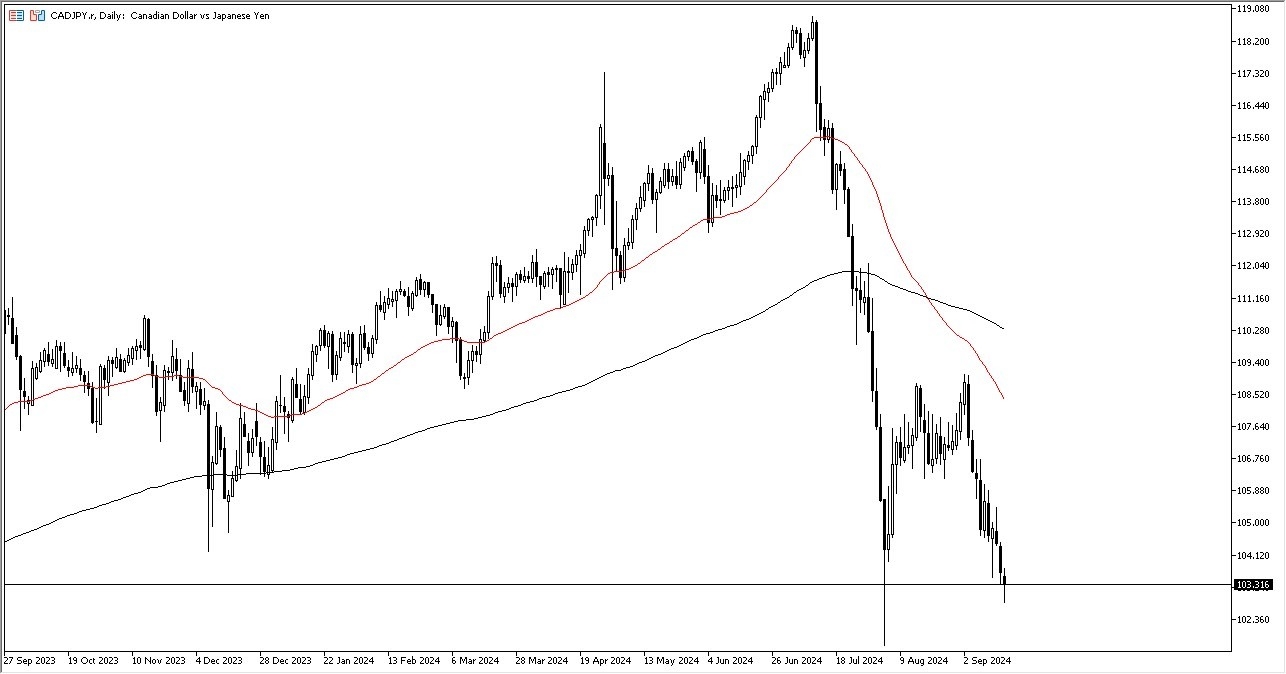

- The CAD/JPY pair looks like it is hanging on by a thread.

- That being said, it’s probably also worth noting that most of the JPY -related markets look the same at the moment, as the Japanese yen has been strengthening against almost everything.

The fact that the Japanese yen is rallying does suggest that perhaps we have a serious problem with risk appetite at the moment, as the Japanese yen is considered to be a safety currency. Furthermore, we also have to keep in mind that the Bank of Japan has an interest rate decision on Friday, as well as a press conference will have a major influence on what happens next. Ultimately, the question becomes whether or not the market believes that the Bank of Japan is going to continue to be very hawkish, or if they will have to blank. I suspect that sooner or later, they will have to blinking acquiesce to the fact that the Japanese have a massive amount of debt that they have to deal with. This does not bode well for the idea of having extraordinarily high interest rates.

Top Forex Brokers

Bank of Canada and Crude Oil

It’s also worth noting that the bank of Canada has cut rates a few times, so the Canadian dollar itself might be a little bit of an odd proxy for risk appetite. However, it’s worth noting that the Canadian dollar is quite often a proxy for crude oil, which of course has been sold off quite drastically. If the crude oil market can turn around and start to strengthen again, that could be positive for the Canadian dollar against the Japanese yen specifically, as the Japanese import 100% of their crude oil, making them the perfect currency to short if the crude oil market really starts to take off to the upside.

That being said, we are in a very dangerous low, meaning that the market could really start to take off to the downside if the Japanese yen picks up strength at this point. Anything below the ¥102 level would really start to cause a bit of a panic in this currency pair and could send it plunging. On the other hand, if we can turn around and retake the ¥105 level, we might see the Canadian dollar put up a fight.

Ready to trade our Forex daily analysis and predictions? Here's a list of regulated forex brokers to choose from.