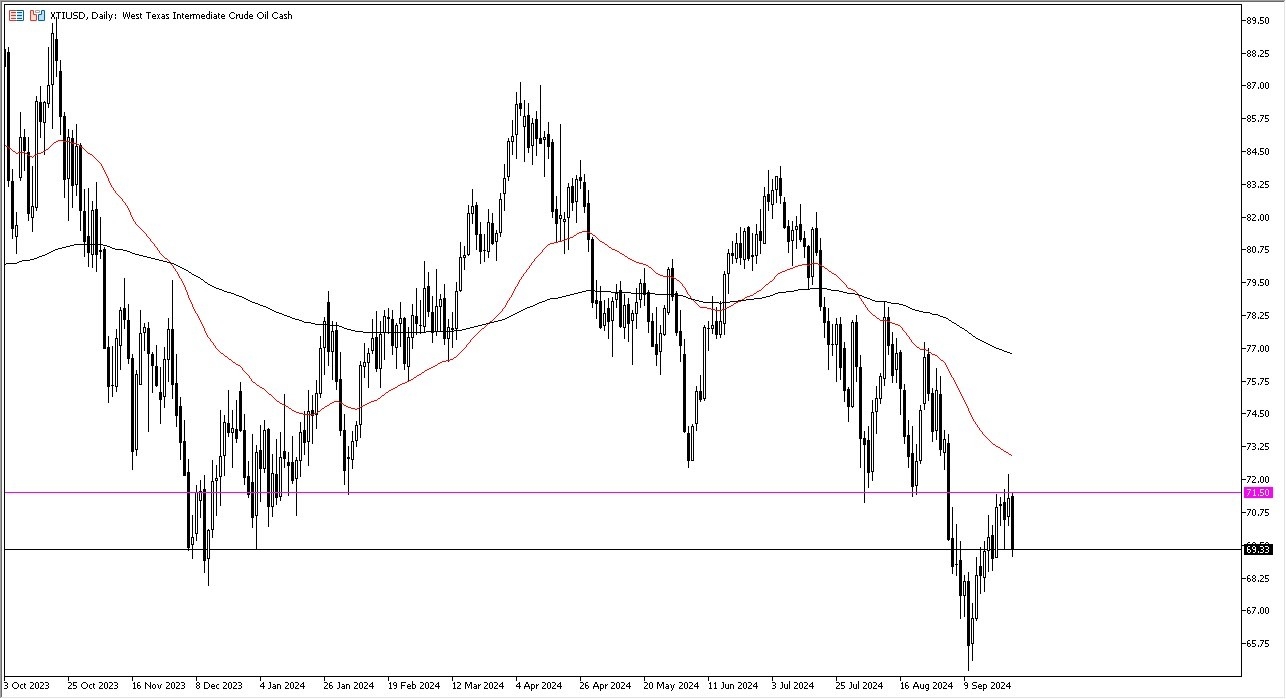

- The West Texas Intermediate Crude Oil market fell a bit during the trading session on Wednesday, as it stands out amongst a significant sell off when it comes to the overall commodity markets.

- Because of this, it’s not a huge surprise to see that the crude oil market fell, as the $71.50 level offers a significant amount of resistance.

- This is an area that also features a major support level in that area, due to the fact that there should be a significant amount of “market memory” attached to it.

- Above there, we also have the 50 Day EMA racing toward that area, and therefore it’s likely that we could see a lot of overhang just waiting to get involved.

The size of the candlestick is of course negative, but ultimately, this is a market that I think comes looking to the $69 level, which of course is a large, round, psychologically significant figure. If we break down below there, the market is likely to continue to go to the downside, perhaps reaching the $76 level, which I think at this point in time is up being a bit of a floor in the crude oil market.

Top Forex Brokers

Global Demand

While we do have to worry about a lot of concerns around the world when it comes to whether or not the market is going to continue to be negative due to the fact that demand could be a major issue. That being said, the US Crude Oil Inventories number came out with a draw of 4.5 million barrels, as opposed to the expected 1.3 million barrels. This does suggest that perhaps demand is still somewhat resilient. That being said, the market is likely to continue to see a lot of volatility, and of course a lot of concerns as to whether or not there is going to be any type of growth. At this point, it looks like the markets continue to be very noisy and negative. With this, I think the downside is somewhat limited, but if we can break above the $72 level, then I think the market has a real shot at least trying to rally.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex Oil trading platforms worth trading with.