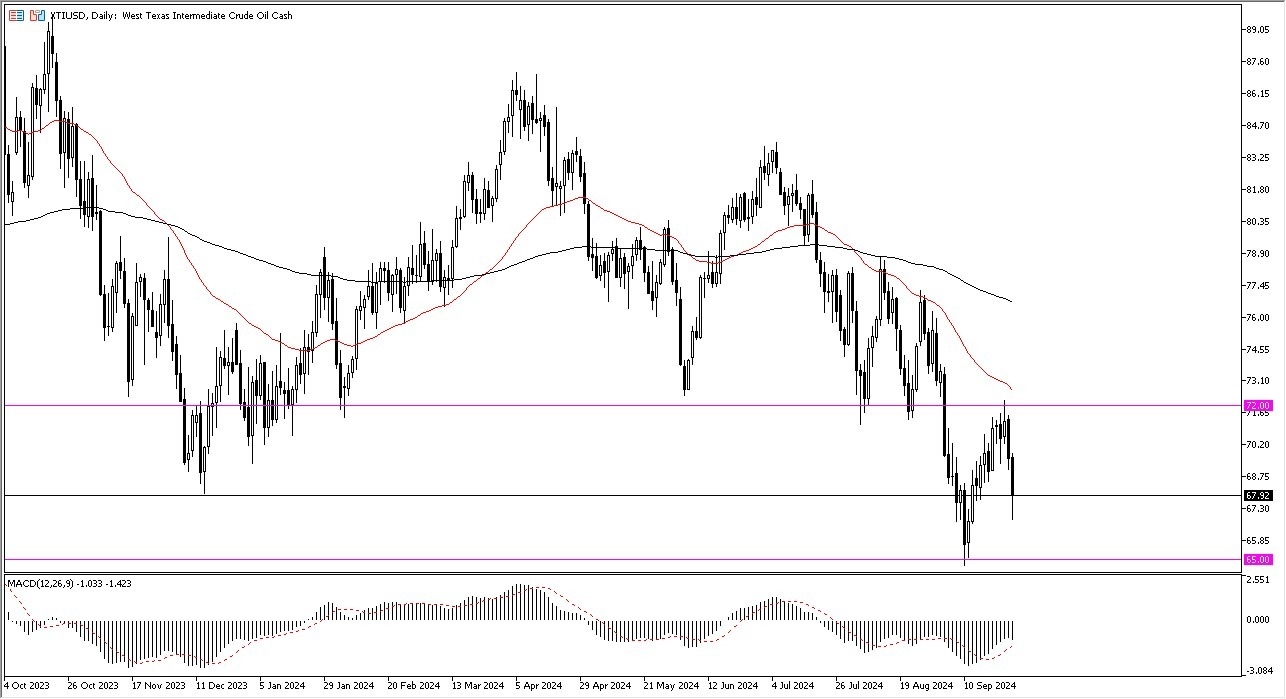

- During my daily analysis of the commodity markets, I’ve noticed that the West Texas Intermediate Crude Oil market has plunged again, to break down below the $68 level.

- Breaking down below the $68 level suggests that we are ready to send the market down to the $65 level.

- The $65 level of course is an area that we had bounce from previously, so therefore I think you’ve got a situation where traders could look at that as a bit of a “hard floor.”

The Moving Average Convergence Divergence indicator is starting to show more momentum to the upside, while price had been dropping, so the question is now whether or not we are getting ready to form some type of bottoming pattern, which would make a certain amount of sense considering that the longer-term charts have shown that the $65 level has been massive support, at least over the last couple of years.

Top Forex Brokers

Crude Oil Continues to Measure Economic Movement

The crude oil market will continue to measure economic movement in the world, and of course potential demand. The employment situation in the United States continues to disintegrate, so it does suggest that perhaps there is going to be a certain amount of downward pressure in this market, as the demand for crude oil tends to fall when you start to see a bit of a recessionary type of market.

However, it’s worth noting that we have bounced quite a bit in the middle of the day, and therefore it’s likely that there is going to be plenty of support between here and the $65 level. If we were to break down below that $65 level, then it’s likely that the market could really start to fall apart, and I think it would also have a lot of negative influence on other markets as well, so the crude oil market is also worth paying close attention to as it can give you a bit of a “heads up” as to how the overall economic momentum continues to break in one direction or the other.

Ready to trade oil price analysis and predictions? Here are the best Oil trading brokers to choose from.