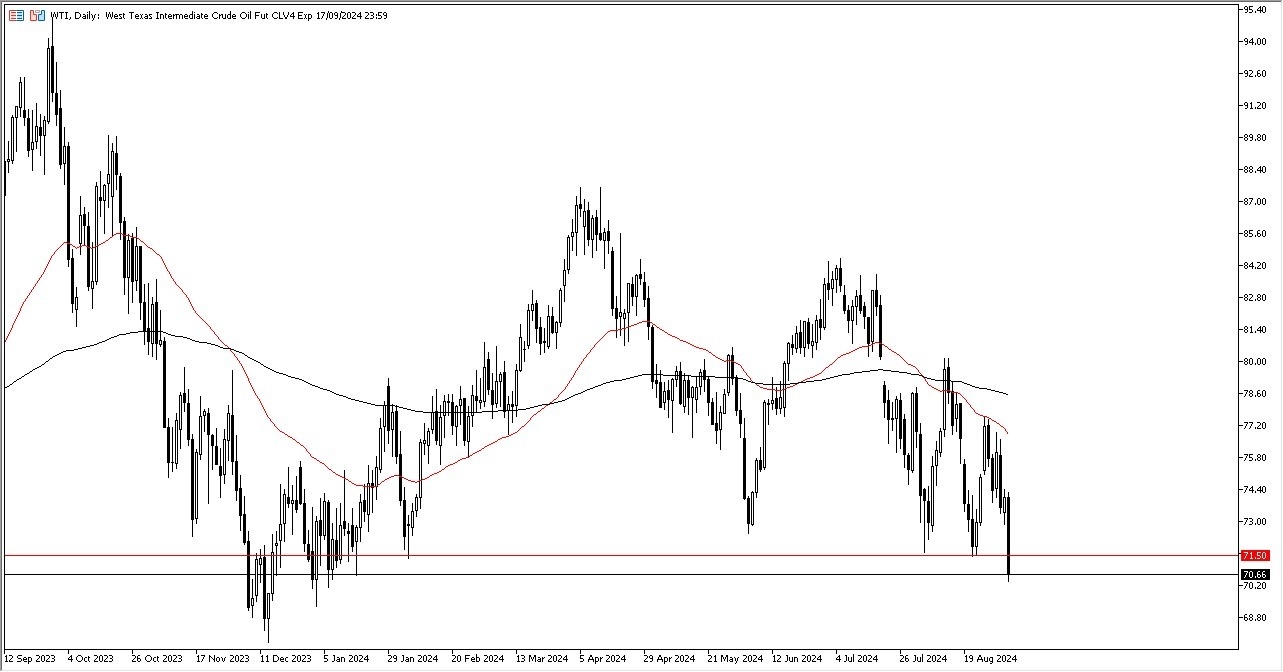

- The crude oil market has plunged rather significantly during the trading session on Tuesday as Chinese demand seems to be cratering.

- That is not a good look for the global economy, and I think a lot of people will be running away from oil in general because of this.

- I don't know how far we can go.

Can we break down below the $68.75 level? Because if we break down below there, we could see a significant sell-off. Short-term rallies at this point in time had to be looked at as potential buying opportunities, but I'd be very cautious with my position sizing. Let us not forget that there is a lot of concern out there when it comes to geopolitics, and it's probably only a matter of time before that comes into the picture.

Top Forex Brokers

On the Other Hand

If we turn around and break above the $74.50 level, then I think we could make a move towards the 200 day EMA. But right now, I think that's essentially the thing as swimming upstream. And it's going to be very difficult. The size of the candlestick is rather negative. And typically, a candlestick like this does not happen in a vacuum.

So, I think you've got a situation where you could very easily see market traders continue to sell off and then perhaps turn back around at the drop of a hat. I do expect a lot of volatility, not only in the oil market, but pretty much everything else as well. With that, you have to be very cautious with your position size, and that's really the only thing you can do if you choose to be involved in this market, is take care and not get over levered. I'm watching this low down at the $68.50 region and if that gets violated, it could be very ugly for oil.

Ready to trade daily oil prices analysis and predictions? Here are the best Oil trading brokers to choose from.