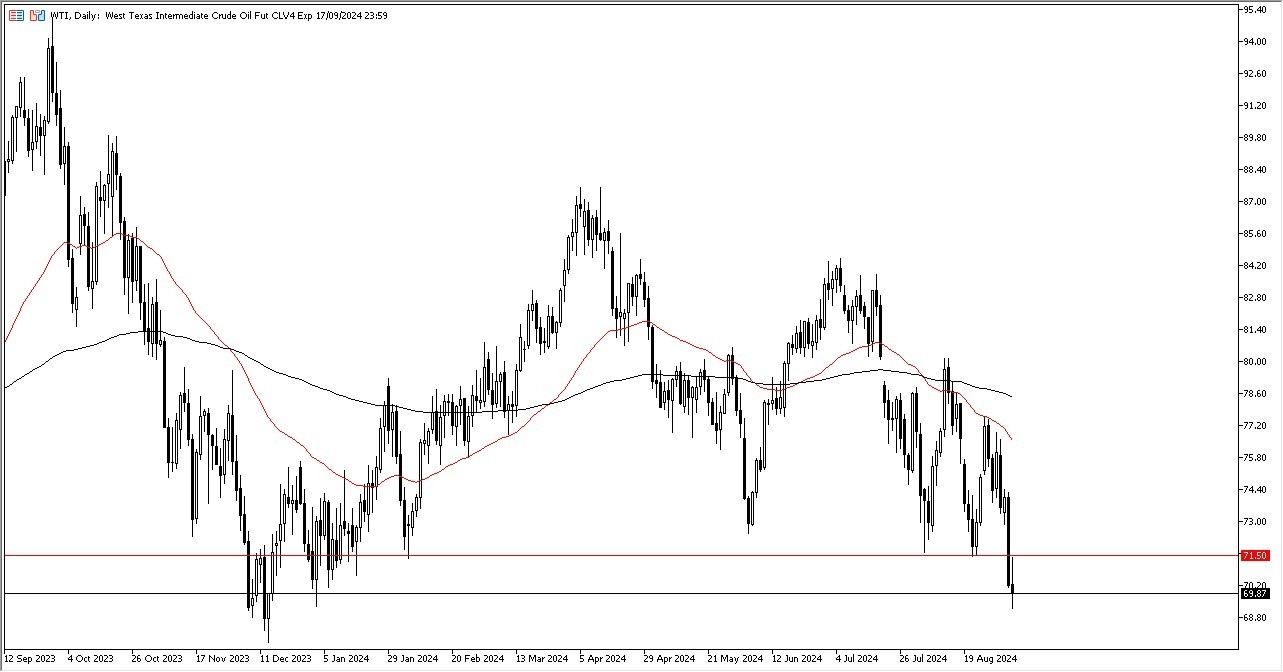

- I recognize that we have a situation where the market is going to continue to be very noisy, as we had initially tried to rally during the trading session on Wednesday but found a ton of resistance near the $71.50 level.

- This is an area that previously had been support so it looks like a bit of “market memory” entered the fray here.

All of this being said, the market is going to be influenced heavily by external pressures, and that’s something that you cannot forget. After all, we have seen Chinese demand dropped, and that cause quite a bit of negative pressure in this market. With that being the case, the market looks like it could continue to be very noisy, but we also have to keep in mind that we are an extraordinarily low levels for this time of year, so I do think that there is going to be a significant amount of pushback.

Top Forex Brokers

Volatility ahead

I think regardless of what happens next, there is going to be a lot of volatility ahead, and that’s something that you need to keep in the back of your mind. If we could recapture the $71.50 level, then we could have a run toward the $74.30 level next. On the other hand, if we break down below the bottom of the trading range for the Wednesday session, we will almost certainly go looking to the $68.50 level, which begins the next major support region.

When you look at the oil market over the last couple of years, we have essentially been bouncing around in a somewhat well-defined $15 range, and we are getting to the bottom of that range right now. If we continue to see concerns about global demand and consumption, that could really start to weigh upon this market even further, causing crude oil to plummet. The question now is whether or not crude oil is starting to price in a global recession?

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex Oil trading platforms worth trading with.