- The West Texas Intermediate Crude Oil market, or US Oil, has been all over the place during the month of August, basically settling unchanged.

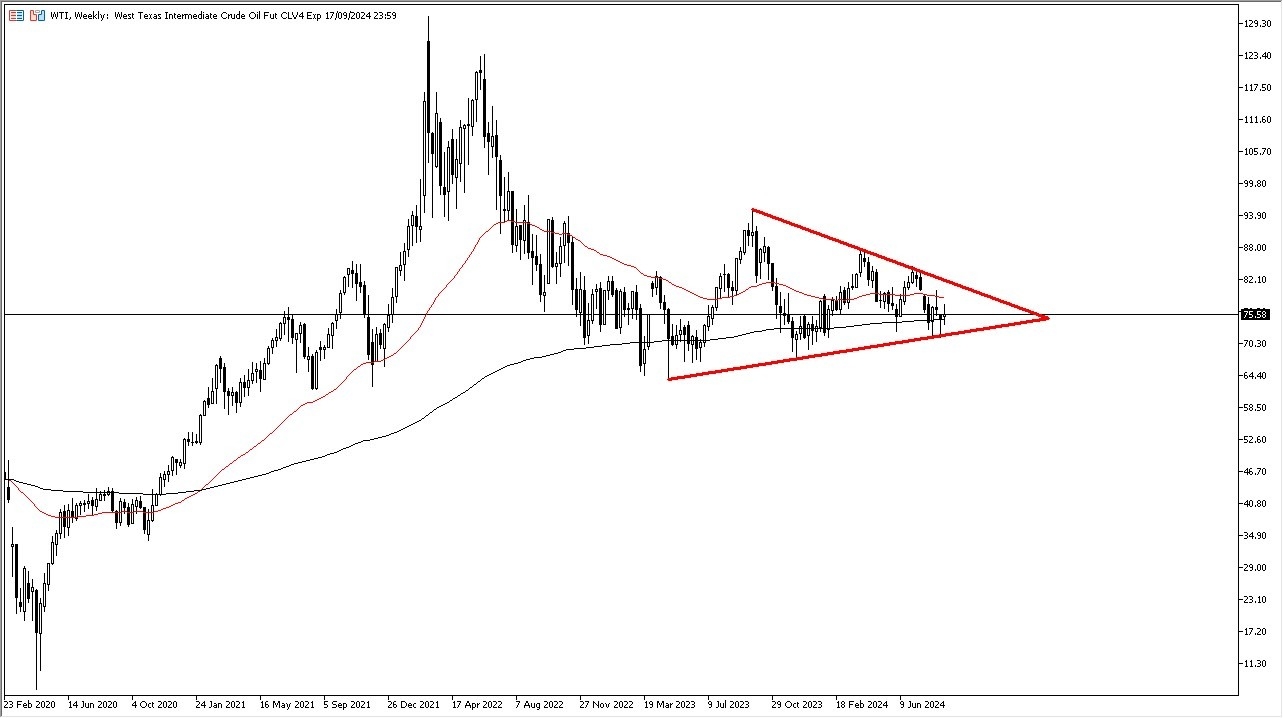

- Because of this, the first thing my eye is drawn to is the fact that we are trading between the 200-Week EMA, and the 50-Week EMA.

- Furthermore, we are also having to look at this through the prism of a symmetrical triangle be informed, and this suggests that sooner or later we are about to see a fairly big move.

I think September could be an important month for the crude oil market as we are going to get information from the Federal Reserve about an interest rate cut, and of course we will have to see whether or not the demand picks up. Keep in mind that the month of August is a bit funky anyway, as there is a serious lack of volume in the market most years.

Top Forex Brokers

The crude oil market has a lot to digest, not the least of which will be whether or not demand picks up, because quite frankly it looks like economies around the world are starting to slow down. If the US economy slows down, that will probably slam this market to the downside, breaking below the $70 level. If we do that, then oil could slip quite a bit. On the other hand, if we were to turn around a break above the $82 level, then I think the crude oil market goes much higher.

There are geopolitical concerns as well, as the war in Ukraine and the Middle East seemingly will never end, and that of course has people worried about oil also. Nonetheless, the real sticking point I believe is whether or not there is going to be enough demand, and I think you’re going to have to watch very closely the GDP of the world’s advanced economies as to whether or not oil has a chance break out. Because of this, and the technical analysis, I suspect that September will probably be somewhat similar to August in its indecisiveness.

Ready to trade monthly forecast? Here are the best Oil trading brokers to choose from.