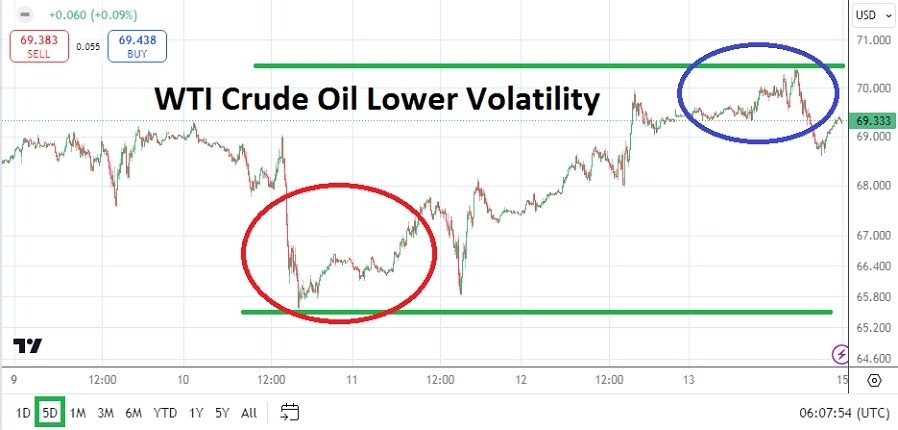

WTI Crude Oil went into the weekend having accomplished its high for the week on Friday, but the commodity still finished trading below 70.000 USD and trading remains skittish.

- WTI Crude Oil touched the 70.400 vicinity on Friday, which was a high for the week and challenged values seen the previous Friday.

- However, WTI Crude Oil ended its trading near 69.330 as the commodity closed for the weekend.

- A low was seen on Tuesday when WTI Crude Oil fell below the 65.500 mark momentarily.

The lower price range of WTI Crude Oil has produced a rather solid trend since the start of July when a price of 84.600 was being flirted upon. Certainly there have been reversals higher when the bearish trend is viewed via a three month chart, but there is no mistaking the notion that WTI Crude Oil market is struggling near its mid-term lows.

Top Forex Brokers

Wider Perspective for WTI Crude Oil

The last time WTI Crude Oil swam within its current price ratios for a sustained amount of time was in the spring of 2023. Since October of last year and the rise in Middle East tensions WTI Crude Oil has had momentary moves higher, but large traders have proven they are more concerned with global economic outlook, and supply and demand issues for the commodity. And based on the trading of WTI Crude Oil via fundamental approach it appears buying has diminished in the energy source as concerns have risen about U.S economic outlook.

Traders have to remember the price of WTI Crude Oil is a looking glass into the outlooks of large traders based on their perspectives regarding future demand. China’s economic data continued to display lackluster results yesterday via Industrial Production, and combined with the thought U.S growth numbers have been facing headwinds the past few months, traders of WTI Crude Oil appear to have a reason to question how strong demand will be over the next six months.

Cautious Price Range as Lows Tested in WTI Crude Oil

The lows seen early last week in WTI Crude Oil can be seen in two different ways. One perspective may be that the depths touched were able to spark a reversal higher which produced a high for the week going into the weekend. The other and not so optimistically is the thought that lows seen were a warning sign that WTI Crude Oil has now entered a market place in which the lower price realms will remain a dominant feature and test the current range with sharp moves via support and resistance levels.

- Until WTI Crude Oil shows that it can sustain prices above the 70.000 USD level and challenge the 72.000 to 73.000 prices consistently, bearish sentiment appears to in control of behavioral sentiment in the commodity.

- Trading early this week will be a solid barometer regarding speculative risk for WTI Crude Oil.

- If the commodity moves below the 69.000 USD level again, traders may want to look for quick hitting moves which test lower support levels with quick hitting targets.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 64.850 to 72.500

Last week’s trading did produce a solid test of lows not seen since May 2023, but the reversal higher indicates large traders felt the selling was overdone. However, the ability to trend lower in WTI Crude Oil should not be forgotten quite yet. Yes, reversal are part of the trading landscape in the commodity on a daily basis and volatility is often part of the wagering landscape, but until WTI Crude Oil can escape its lower price realm it might prove costly to believe a strong and sustained move higher is going to emerge.

Economic data from North America, Europe and China continue to show lackluster economic growth which highlights that demand will remain abundant, but perhaps not show any remarkable increases in the mid-term. Day traders of WTI Crude Oil should brace for the lower price range of the commodity to remain a speculative play and choose their targets cautiously this coming week.

Ready to trade our weekly forecast? Here’s a list of some of the best Oil trading platforms to check out.