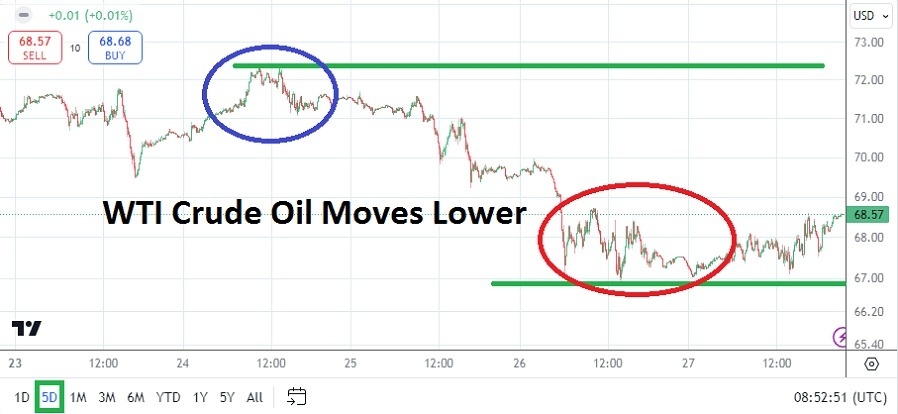

After starting this past week of trading with anxious buying and creating a high of nearly 72.380, WTI Crude Oil saw a shift in sentiment and a return to lows which challenged support and made it look vulnerable.

- WTI Crude Oil went into this weekend near the 68.570 ratio, this after touching a low of almost 66.900 on Thursday.

- But before traders think that the achieved move higher represents a significant reversal, traders should consider WTI Crude Oil sustained lows well into Friday’s trading and only managed a slight reversal higher.

The price of WTI Crude Oil remains within the lower boundaries of the commodities long-term value range, prices from the early summer of 2023 remain targets for some bearish perspectives possibly which are looking at technical charts. However, as the Middle East conflict continues to make news one eye should be kept on the potential of developing news which could provide upwards impetus. Yet, relying on nervous buying has proven a losing bet for many bullish day traders who do not take into consideration that large players in WTI Crude Oil actually seem to be calm regarding supply.

Top Forex Brokers

Early Price Higher Last Week Reversed Back to Support

Last week’s price action certainly did see slight movements higher on Monday and Tuesday, but importantly the higher elements of the near-term price range could not be sustained. Selling started to develop on Wednesday and when the 70.000 price ratio started to look further away and lower prices were established, more bearish momentum built and caused price velocity downwards on Thursday.

Late news on Friday from the Middle East might have ruffled some feathers in WTI Crude Oil, but they were not dynamic enough to cause a massive shift in sentiment. WTI Crude Oil went into this weekend near lows and traders who want to look for sudden moves higher need to understand that large players may be taking into consideration weak economic data from China and the European Union as a factor in their mid-term outlooks. Technically the simple fact that Crude Oil remains within the lower elements of its long-term price realm should be enough to tell you that there is a lack of strong buying.

Day Trading WTI Crude Oil this Week

Traders should be careful upon the opening early tomorrow in WTI Crude Oil, this will tell a lot of the story regarding sentiment. If WTI stays within the lower boundaries of its price realm and does not challenge the 69.000 level in the first few hours and sustain prices above, this will be a signal that many large players in the energy sector remain calm and believe for the time being that equilibrium remains in a fairly balanced stance.

- Traders may want to look for reversals if the price of Crude Oil does go above 69.000, but isn’t able to develop another leg up and challenge the 70.000 mark on Monday.

- U.S economic numbers may factor into Crude Oil later this week per behavioral sentiment that develops after the U.S jobs numbers this coming Friday.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 65.900 to 72.300

WTI Crude Oil has gotten plenty of attention over the past year due to the Middle East conflict, but trading has proven to be rather calm and has created a downwards slope since highs were seen in April of 2024. The path lower has not been a steady avenue, reversals have certainly been seen, but resistance has incrementally lowered. The notion that economic outlook from the major geographical centers, in North America, Europe and Asia, who are the largest consumers have become negative has influenced the lower movement of WTI Crude Oil.

Resistance around the 69.000 to 70.000 marks should be watched early this week; if these ratios prove durable Crude Oil may continue to challenge lower depths in the coming days. If WTI jumps higher and begins to challenge the 71.000 to 72.000 ratios this could be a signal there is some nervous buying taking place, but it also may be a good area to look for reversals lower again.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.