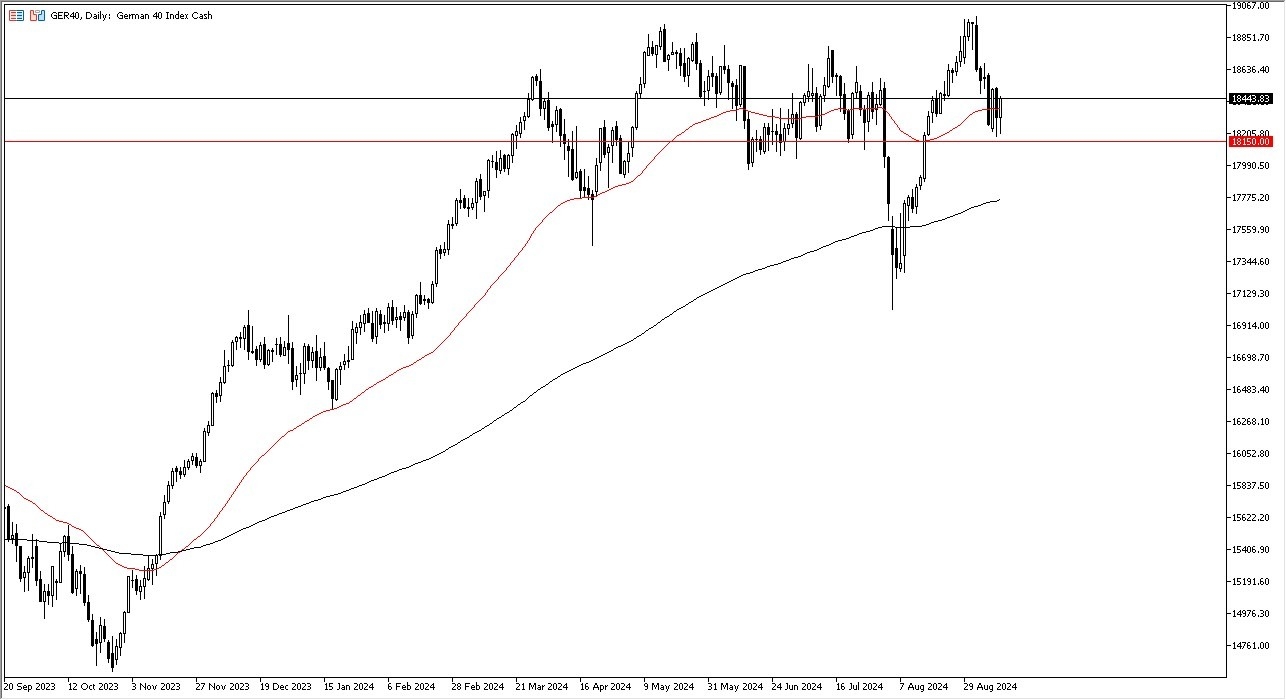

- The German index initially pulled back just a bit during the course of the trading session on Wednesday, only to reach down towards the 18,150 level before turning around and showing signs of life.

- All things being equal, the market does look like it's in the midst of consolidating as we are also looking to continue the longer term uptrend.

- Whether or not this can happen remains to be seen but it certainly looks like we are going to have a serious go at it.

Keep in mind this is a market that people run to initially when they are trying to invest in the European Union, so with that being said it makes a certain amount of sense to watch this market regardless of what you are trading.

Top Forex Brokers

The DAX of course is a major index for global trade and is by far the largest index in the European Union. So, therefore this is a scenario where a lot of people will be looking at whether or not there is risk appetite out there, I do think that given enough time, we probably see risk appetite return just simply because bankers around the world are getting excited about that cheap and easy money. That doesn't necessarily mean the economy won't be a huge mess, but the stock market itself is clearly not paying attention to reality, at least until it starts to do so.

Is it a One-Way Trade?

We have a situation where it's more or less a one-way trade in most major indices. If we were to break down below the 18,150 euro level, then we could drop to the 200 day EMA, but right now it doesn't look like that's about to happen. In fact, it looks like it's very well supported, and we will continue to consolidate and then eventually try to go higher from what I can see. This doesn't mean it will be easy, but it certainly looks like we are trying to continue this behavior.

Ready to trade our stock market forex forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.