- During my analysis of minor currency pairs during the trading session on Tuesday, I can't help but notice that we are all over the place in multiple different currency pairs and the Euro against the Australian dollar won't be any different.

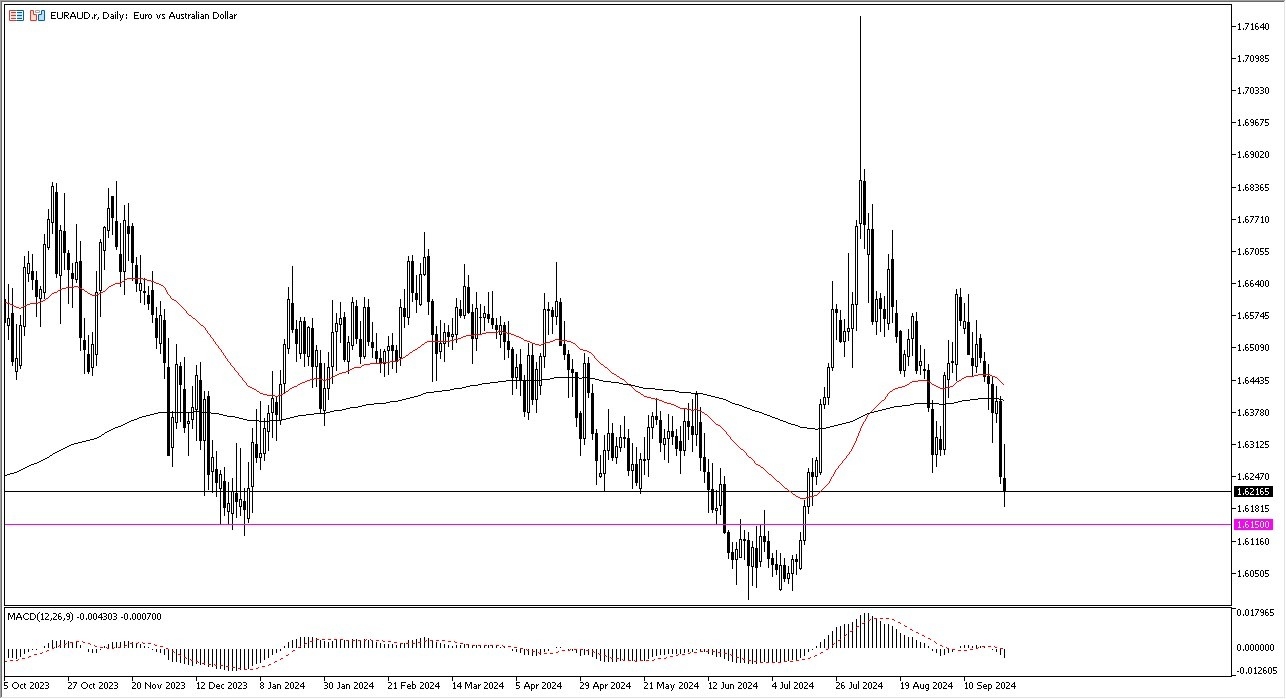

- When I look at the chart, it's obvious that the recent move over the last couple of days has been decidedly negative, especially with the Monday session being such a massive sell-off.

- However, the Tuesday session has seen a little bit of a bounce, as it looks like the 1.6150 level could continue to offer support.

Underneath there we have quite a bit of support that extends all the way down to the 1.6 level, which obviously is a large, round psychologically significant figure. And therefore, I have to question whether or not this is going to be a bit of an area of a potential basing pattern, assuming we even get down there. If we turn around and break above the top of the Candlestick for the Trading session on Tuesday, then it opens up the possibility of a move to the 200 day EMA, possibly even the 50 day EMA.

Top Forex Brokers

On a Move Higher

Anything above that level then opens up the possibility of a much bigger move. I think at this point, we are trying to see a lot of sideways choppiness as the euro, of course, moves against the US dollar. But at the same time, the Australian dollar is highly sensitive to commodity markets and global markets overall, as well as Asian markets.

Asian markets buy most of their hard commodities from Australia. So, there's your connection at this point, I think we are looking for support. A bit of a bounce could be a buying opportunity, but right now I think you need to see a couple of days’ worth of sideways action first.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.