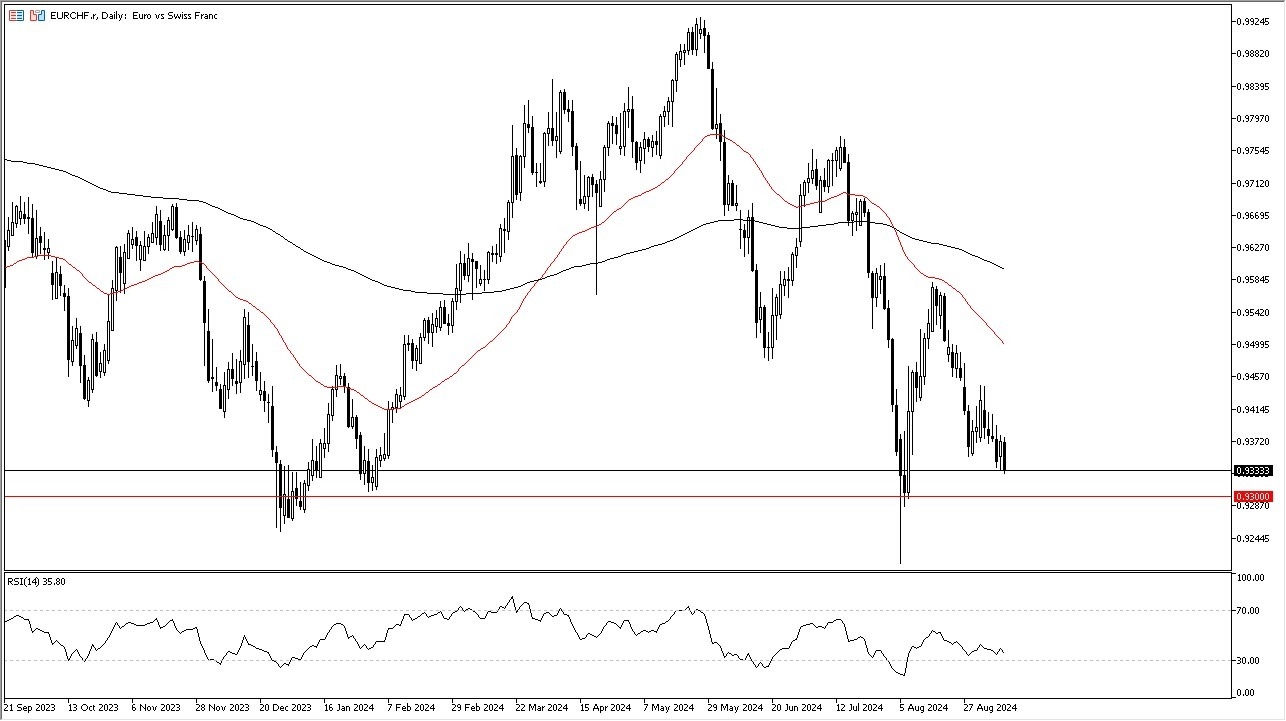

- The Euro has fallen quite a bit during the trading session on Tuesday against the Swiss franc.

- It looks at this point in time as we may be getting ready to test that the 0.93 level.

- The 0.93 level underneath is rather supported as we have seen the market bounce from there a couple of times so I think it'll be interesting to see how this market plays out once we get down there.

In general I think this is a situation where sooner or later we will get a bit of a bounce. Perhaps traders will try to jump in but if we were to see something different like a move below the 0.93 level then it's likely that we could go down to the 0.92 level. There is a massive amount of support in this region, and it is worth noting that the Swiss National Bank pays close attention to the exchange rate of the Swiss franc against the euro.

Top Forex Brokers

Keep in mind the overall relationship

The European Union is Switzerland's biggest trade partner so that always grabs their attention. We bounced from this area before reaching all the way up towards the 0.9950 level. So that tells you how important it is. Whether or not we bounce again, we don't really know yet, but it certainly looks like it's a market that I think given enough time, there'll probably be some value hunting down here. Because if we break down below the 0.92 level, that opens up the trap door for this market starts to fall quite rapidly. This is a risk on risk with the Swiss franc of course being favored in times where people are nervous.

Ultimately, this is a market that I think will continue to be very noisy but sooner or later we will see buyers underneath willing to get involved and pick up cheap euros. In general, I also believe that this is a market that has somewhat of a limited downside but if we see some type of massive sell off, then it means that the global financial system will be freaking out.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.