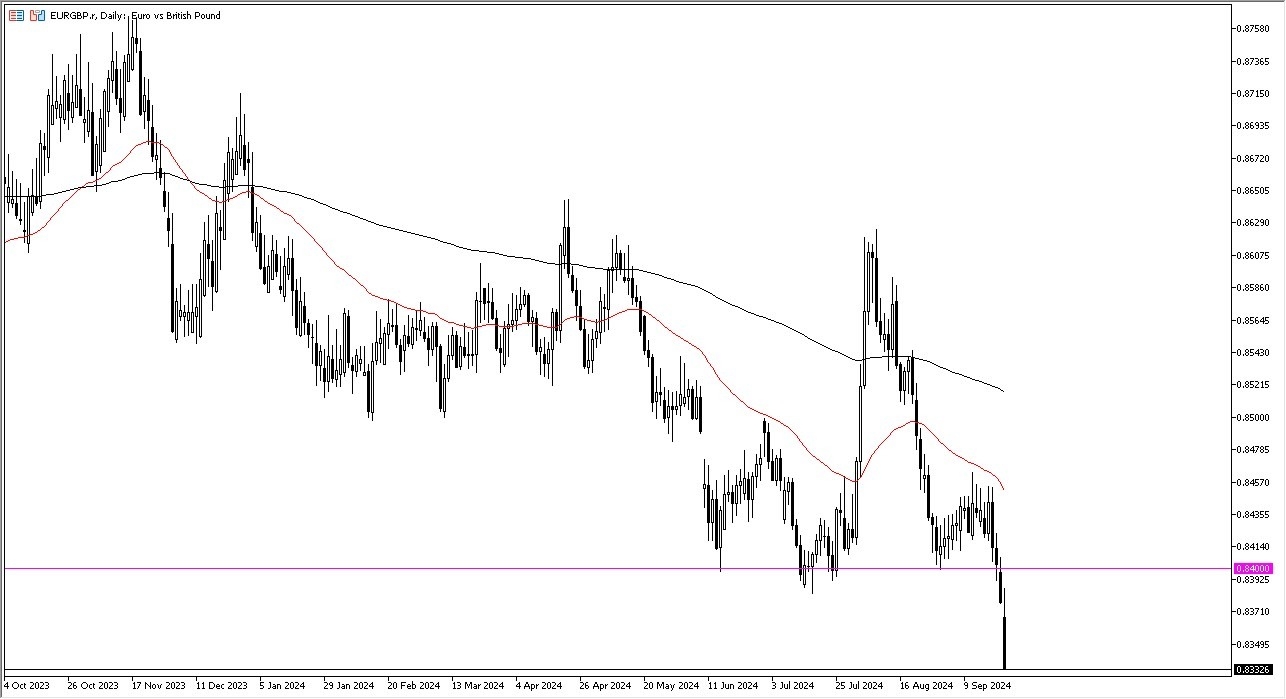

- I believe that the EUR/GBP pair is worth watching due to the fact that we have absolutely collapsed at this point, and it looks like the market is likely to continue to see traders favor the British pound over the euro.

- The 0.84 level has been an area that a lot of people paid close attention to previously, and the fact that we have now sliced through it rather handily suggests that this pair has much further to go to the downside.

Furthermore, it’s probably worth noting that the Bank of England chose to stand still as far as interest rates are concerned, and this is an obvious reaction to that. In general, this is a market that I think is going to start looking to the 0.83 level, which is a large, round, psychologically significant figure and an area that we have seen a lot of buyers in previously. If we break down through there, then it’s likely that they absolute floor will fall apart, and we could see the EUR/GBP market just dropped drastically.

Top Forex Brokers

Looking at this chart

Looking at this chart, there’s absolutely nothing positive on it, with perhaps the lone exception of the 0.83 level being an area that some people may be looking for to bounce. However, we would have to break above the 50 Day EMA in order to see some type of turnaround and a push to the upside that allows the market to go looking to the 200 Day EMA. Ultimately, I think this is a market that is in freefall, and it is very likely that we will continue to see a lot of money flow out of the EUR and into the GBP. In general, I think this is a situation that will continue to see a lot of questions asked about the overall attitude of risk appetite and of course the idea of whether or not we are going to see the European Union finally turn around and strengthen, or if the fact that the ECB has cut a couple of times in the BOE hasn’t bothered continue to push this market around

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.