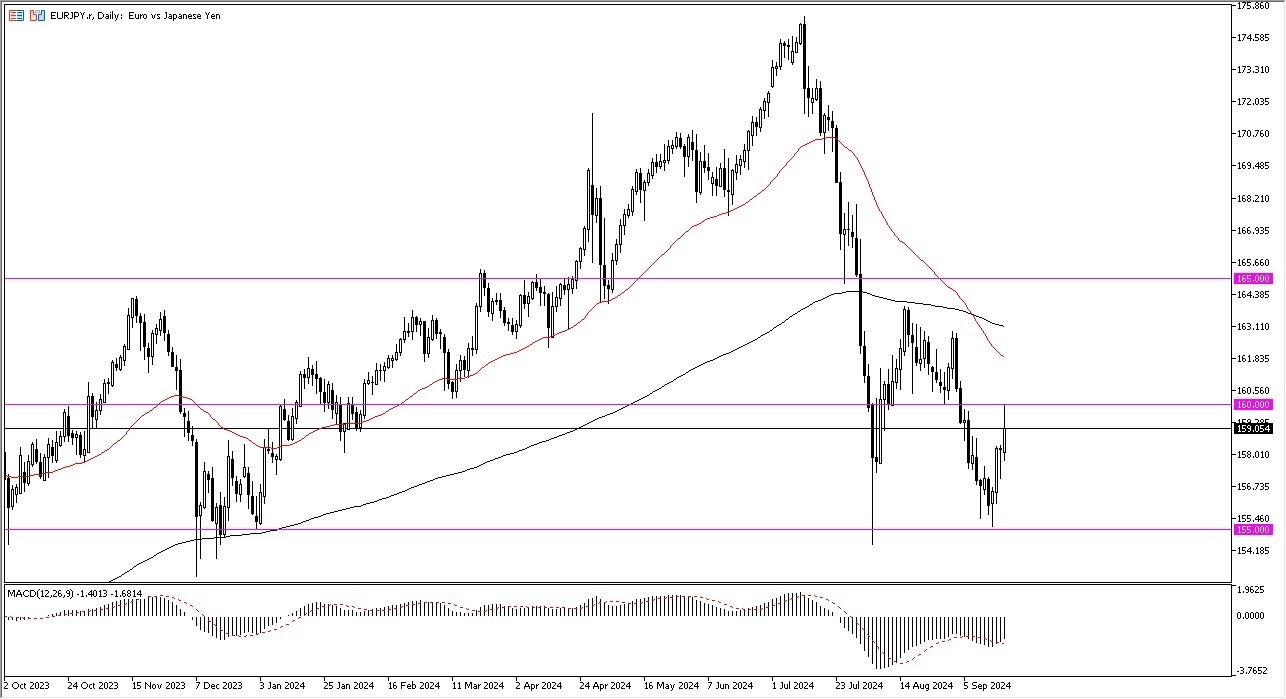

Potential signal:

- On a daily close above the 160 yen level, I will be buying.

- I will have a stop loss at 158.80 yen, and will be aiming for the 164.50 region.

The euro has shot higher against the Japanese yen in early trading on Thursday to reach the 160 yen level. However, that area seems to have offered a bit of resistance. So I find it interesting that we have turned around and dropped pretty significantly from there. This tells me that perhaps traders are trying to go a little more risk on with the risk perhaps leaning towards higher yielding currencies due to the Fed cutting interest rates by 50 basis points. But you have to keep in mind Friday morning features the Bank of Japan and its latest interest rate decision.

Top Forex Brokers

Because of that, we may have jumped the gun. However, one thing that this move has set up is a pretty obvious potential trade, meaning that if we break above the 160 yen level, then I think you probably have more momentum entering the market. The MACD has shown itself to be in divergence from the actual price action, so that might be something worth paying attention to as well as it could be a hint that we are in fact bottoming, which would make a certain amount of sense considering we dropped 20 handles at one point. That is a huge move in the currency over the course of an entire year, let alone just a few months.

Short Covering Rally? Maybe.

So, with that being said, it does make sense that we rally mainly just if for no other reason, then those who sold short will eventually want to take profit. But also, if we do have a little bit more risk coming into the picture, or if the Bank of Japan sounds dovish again on Friday, that could very well end up being a sign that the yen has peaked, and other currencies are going to turn around and start taking off against it.

Ready to trade our daily forex signals? Here are the best forex brokers in Japan to choose from.