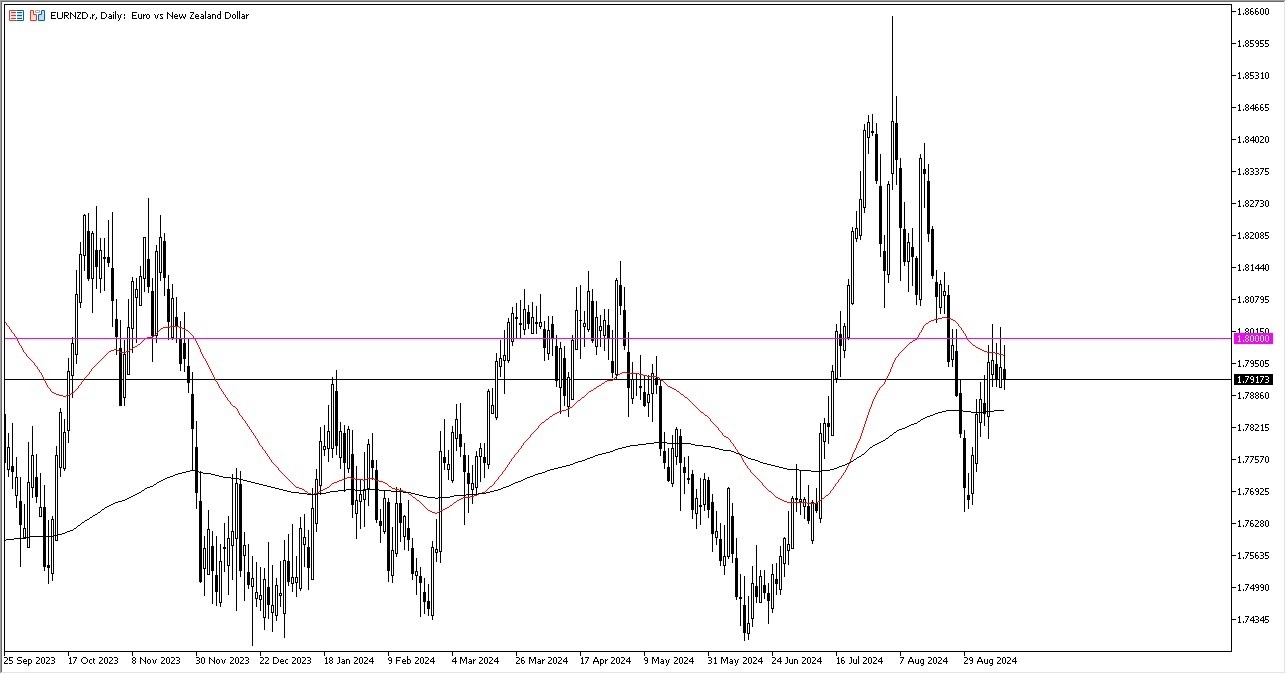

- The Euro had initially tried to rally during the trading session on Thursday, but it looks like the 1.80 level continues to offer significant resistance at this point in time.

- We also have the 50 day EMA, and this of course is an indicator that a lot of people will be paying attention to due to the fact that it is a large widely followed indicator, but it is also right at this large round psychologically significant figure.

- All things being equal you can draw a Fibonacci retracement tool, and you can see that we have just bounced and then pulled back from the 38.2% Fibonacci retracement level.

Pay close attention to the euro

All things being equal, we have to pay close attention to the Euro itself, as it of course is suffering with ECB rate cuts earlier in the day. That does make it a little less attractive. Whether or not this is a market that I think really takes off to the downside is a completely different question, but we clearly have a lot of work to do if we wish to rise above the 1.80 level. This obviously is an area that a lot of people have paid attention to recently, and I don’t see a reason why that would change anytime soon.

Top Forex Brokers

If we did, the next major area is going to be 1.8150. On a move to the downside, we have the 200 day EMA hanging around the 1.7850 level, and breaking below there, we have the possibility of dropping down to the 1.77 level.

Regardless, I do think this is a market that's going to remain very noisy, but it does look a bit tired, at least in the short term. So, I'll be watching for selling opportunities in this market, due to the fact that the overall attitude of the market will be very binary from a “risk on/risk off perspective.”

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.