Potential Signal:

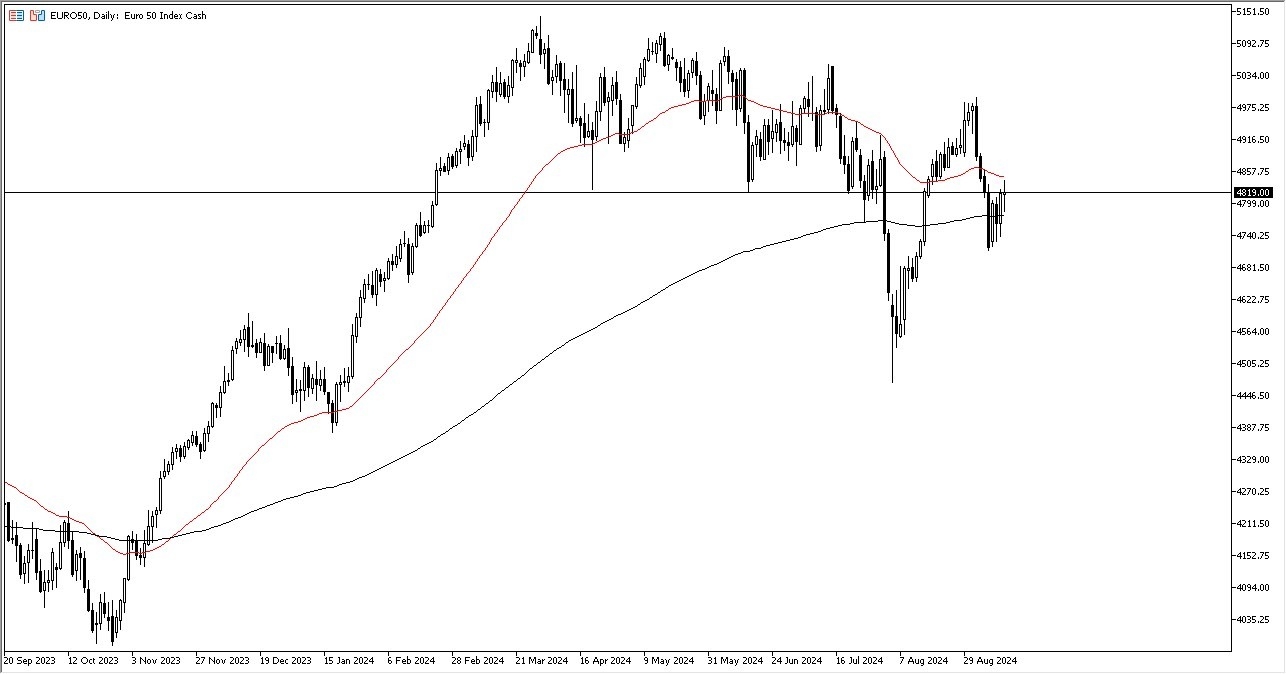

- If the EuroStoxx 50 breaks above the 50-Day EMA, I would be a buyer of this index, aiming for the €4975 level.

- I would have a stop loss at the €4790 level.

In my daily analysis of global indices, the EuroStoxx 50 looks very interesting, as it has pressured the 50-Day EMA above. If we can break above that indicator, it would obviously be a very bullish sign and could open up the possibility of a move to the €5000 level. Keep in mind this index is an index of multiple countries, so gives you an overall picture of what’s going on in the European Union.

It’s worth noting that the European Central Bank has cut rates during the trading session, so it does perhaps offer a little bit of a boost for the idea of stocks going higher. However, there’s also concerns about whether or not the European economy may be struggling, because quite frankly the market is likely to continue to see a lot of questions asked about whether or not the ECB will be cutting based on trying to stimulate the economy, or if they are going to be cutting based on fear.

Top Forex Brokers

Noisy action ahead

I believe at this point, it’s easy to see that there will be a lot of action ahead, not only in the EuroStoxx 50, but most indices overall. After all, there is a lot of uncertainty out there, and that of course has its own influence on market participants as we try to gauge whether or not the economy is going to slow down softly, or if it’s going to go crashing. It seems like you can make an argument for either happening, and at this point in time it will continue to be a scenario where uncertainty will rule the day. Because of this, we need to look at technical analysis as a potential way to go forward.

Because of this, I am approaching this as a “binary trade” type of set up, as the market participants will continue to see the moving averages come into play. It looks like we are trying to rally, but there is a bit of a hesitation to this market.

Start trading our daily Forex signals. Get our Forex brokers that work with CFD trading here.