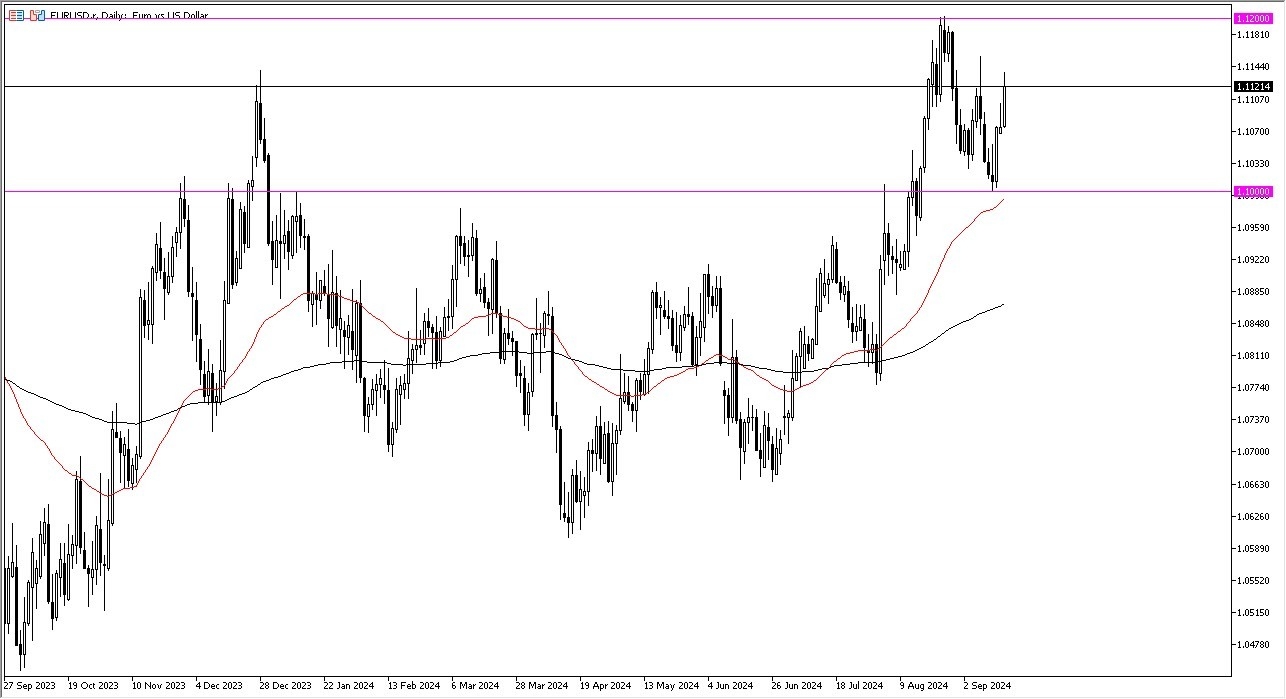

- It was a very strong day for the euro against the US dollar on Monday as we broke back above the 1.11 level.

- This is an area that has caused a little bit of noise as of late but quite frankly that being said, this is a market that I think has to be thought of through the prism of what happens on Wednesday with the press conference after the FOMC interest rate decision.

- We already know that the Federal Reserve is likely to cut by 25 basis points, but the question then will become how does Jerome Powell sound afterwards? If he is, in fact, extraordinarily dovish, then I think you will see the Euro really take off.

If we can break above the 1.1250 level, then it becomes a longer term move. It somewhat looks like a bullish flag at the moment, but I'm not overly excited about it because I do recognize that we also have not only the FOMC, but we have the Bank of England and the Bank of Japan. And while that won't directly influence what happens with the Euro, it will certainly influence what happens with the US dollar.

Top Forex Brokers

Volatility Ahead

So, you will see volatility in this pair after those central banks get involved as well. Wednesday, Thursday and Friday are all going to be very choppy and noisy days. And as you can see on the chart, I have marked the 1.12 level as a swing high and the 1.10 level underneath as a swing low.

The 1.10 level is also backed up by the 50 day EMA. So, it all comes into the picture to squeeze us in this little box, we'll hopefully be able to break out of it this week. If we were to do that, it’s likely that we would see the US dollar get hammered against almost everything, and at this point in time it’s likely that we would see the biggest move after Wednesday and that announcement.

Ready to trade our EUR/USD Forex analysis? We’ve made this forex brokers list for you to check out.