- In my daily analysis of minor currency pairs, I’ve been focusing on the GBP/AUD and other British pound-related pairs.

- The Bank of England’s decision to keep interest rates steady during the early hours suggests potential support for the British pound moving forward.

Keep in mind that the Australian dollar is of course a commodity currency, so it does have quite a bit of influence on it from external pressures abroad. For example, if gold market start to rally, this will typically lift the Australian dollar over the longer term, as there are so many gold miners in Australia. Furthermore, Australia is also highly levered to the Asian economy, specifically the Chinese economy, as the Australians are heavily levered to what happens in China as they are one of the biggest exporters to that country.

Technical Bounce

Top Forex Brokers

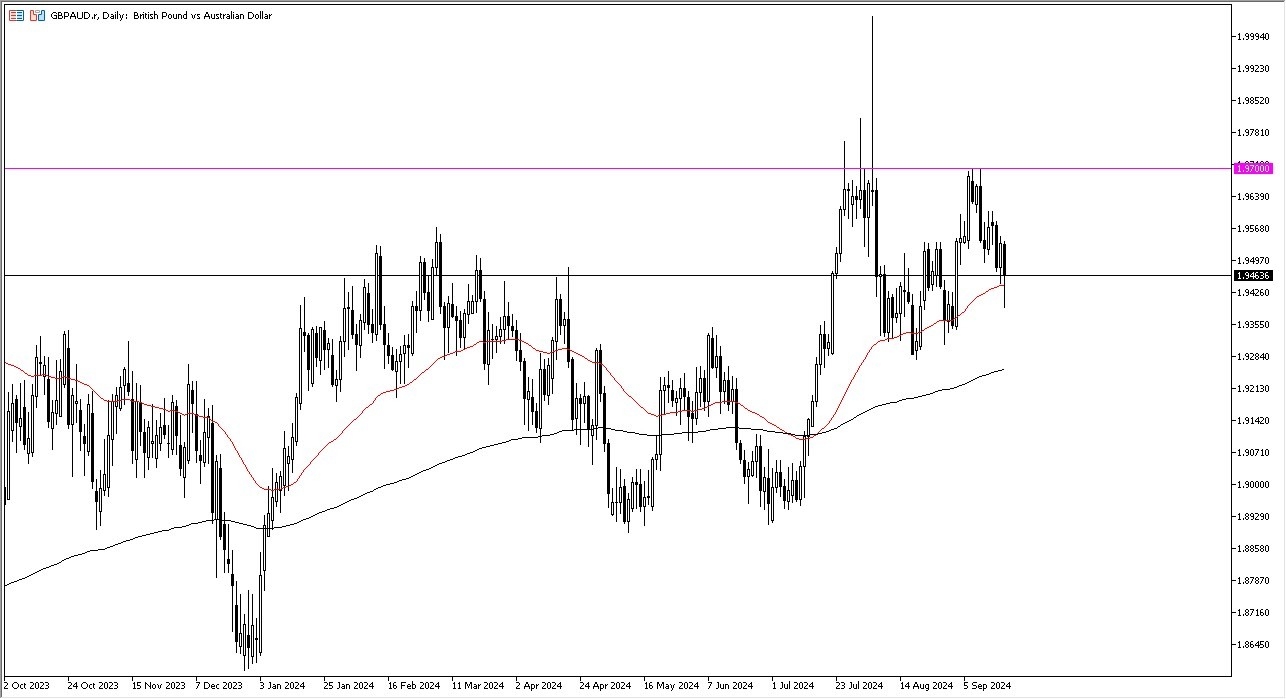

It’s possible at this point in time that the bounce is just simply a technical one, as the 50 Day EMA would attract a lot of attention. Breaking down below the bottom of the candlestick for the trading session on Thursday would be a very negative turn of events, but we also have support at the 1.93 level and the 200 Day EMA that could both come in and pick the market up.

When I look at this chart, it’s not a real stretch to think that we are in the midst of forming some type of the ascending triangle, but it’s a bit sloppy and I don’t know that I put too much stock into this potential pattern, but it is something worth watching. Obviously, if we were to turn around and break above the 1.97 level, it would be a major break out in this pair, and we could see the British pound really start to punish the Australian dollar at that point. It’s also worth noting that about a month ago we broke through that level and shot straight to the 2.00 region where we turned around and informed a nasty shooting star. In other words, I think things continue to be very noisy in this pair, but I like the idea of buying the dips overall.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.