Potential Signal:

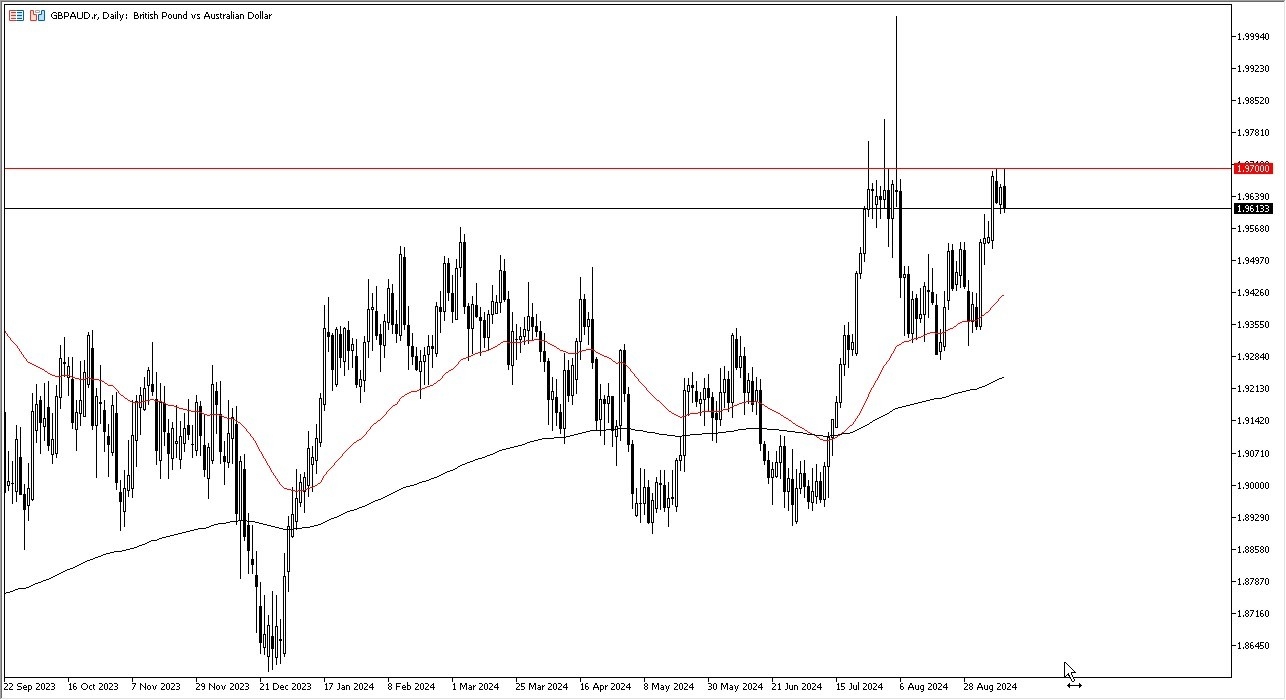

- In this pair, I believe that a move above the 1.97 level on a daily close would signal something rather big is happening.

- I would be a buyer, and I would have a stop loss at the 1.96 level.

- I would be aiming for the 1.9950 level over the longer term.

- The GBP/AUD pair stands out as we have seen such a “brick wall” form of the 1.97 level.

- This is an area that has been important multiple times over the last several months, so the fact that we have pulled back from there is not overly surprising.

- Furthermore, it’s worth noting that the GDP month over month numbers coming out of the United Kingdom came out at 0.0%, which of course is a bit of a shock considering it was anticipated to be 0.2%.

Top Forex Brokers

In other words, it was bad news for the British pound, but it’s also worth noting that we may have gotten a little extended to begin with. Whether or not this leads to something bigger remains to be seen but a lot of traders out there are starting to suggest that perhaps the Bank of England will cut rates further. This also sets up an obvious trade that we will have to wait and see whether or not it kicks off.

Technical Analysis

The technical analysis of this pair is rather bullish despite the fact that we continue to struggle with the 1.97 level. This is an area that’s been like a brick wall, and that’s not something you see very often in the Forex world. It is because of this that I am paying close attention to how this market behaves, as there seems to be quite a bit of pressure above that area, even though we had a massive spike all the way to the 2.00 level several weeks ago.

Keep in mind that the Australian dollar is highly sensitive to commodity markets, so that could also come into the picture, but right now it looks as if the market is more likely than not going to continue to see more support underneath, especially near the 1.95 level. As things stand right now, the 1.96 level has contained the selling pressure so far, so all be watching this pair closely.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.