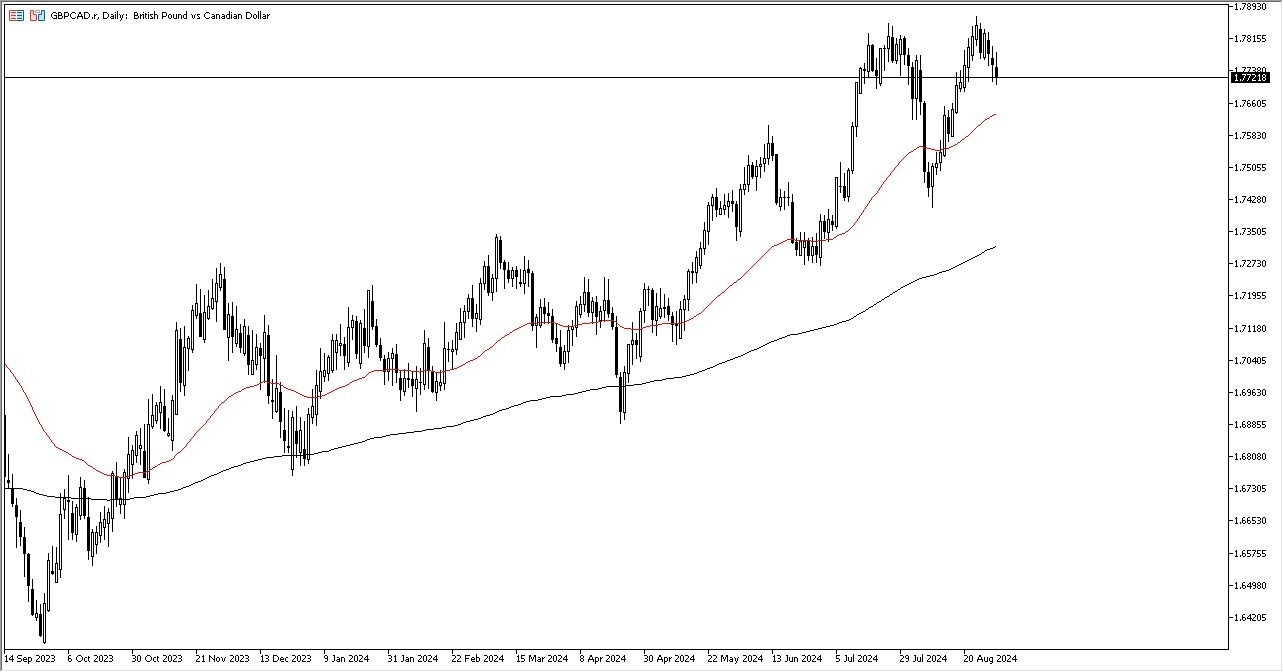

- The British pound initially tried to rally against the Canadian dollar on Friday, but then gave back gains to show signs of hesitation.

- We have formed a little bit of a double top, but I also think that it's only a matter of time before we turn around and try to break out above there.

- Short term pullbacks I think continue to be a very possible turn of events, but the 50-day EMA underneath is likely to continue to be important as well.

If we break down below the 50-day EMA, then the market could go down to the 1.74 level. On the other hand, if we do break above the 1.79 level, then it's likely that we will go looking to the 1.80 level.

Top Forex Brokers

That being said, the market is likely to see a lot of chop back and forth. And I do think that ultimately there are plenty of people out there who will be looking to take advantage of the interest rate differential. Furthermore, it's probably worth noting that the Canadian economy seems to be slowing down. We got the GDP numbers coming out at flat during the session on Friday, month over month.

Potential Double Top

When you look at the longer term charts, you can see that we have formed a little bit of a double top on the weekly chart, but really this is just a matter of pressure. On even longer term charts, it's worth noting that the area right around 1.7850 has historically been important. So, this pullback is not a huge surprise. On a bounce, I'm more than willing to get involved in this pair and continue to ride the British pound higher as the Bank of England is much tighter than the Bank of Canada and will remain so. Because of this, I think this is a market that will continue to be positive over the longer-term, but we may need to pullback in order to attract a bit more value hunting out there.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.