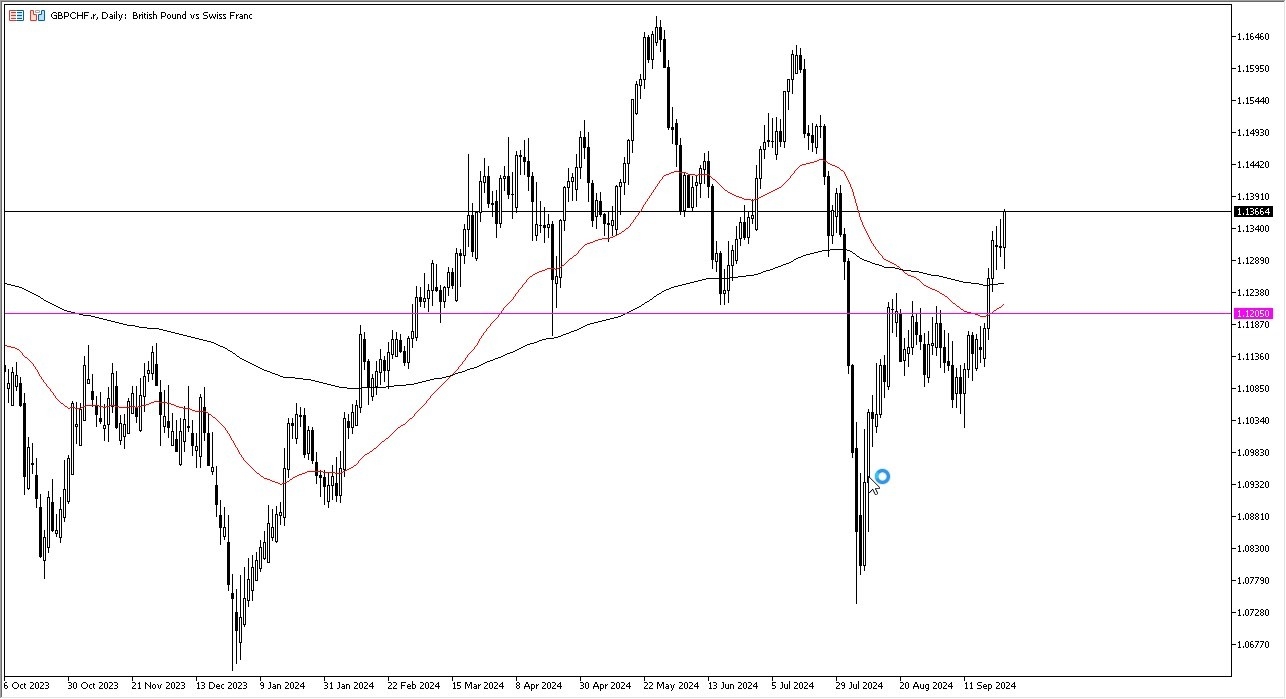

- The British pound pulled back initially against the Swiss franc during the trading session on Wednesday, to reach toward the 1.13 level and the 200-day EMA, only to turn around and show signs of life again.

- All things being equal, if we continue to go higher, I think the 1.14 level will be a bit of a barrier.

It is interesting that the 200 day EMA has offered a significant amount of support. And I think the fact that the 50 day EMA is starting to race to the upside could kick off the so-called golden cross eventually, which a lot of technical traders pay close attention to. It's worth noting that we had previously formed a bit of a bullish flag, and I think this does suggest that there are buyers out there willing to get involved.

Top Forex Brokers

Interest Rates and this Pair

In general, the interest rate differential continues to favor the buying of this pair as the Bank of England held firm at 5% while the Swiss have cut a couple of times from an already low level. So, in other words, you get paid to hang on to this position. I think that's a lot of what you are seeing. With that being the case, I like the idea of buying the dip.

I don't have any interest in shorting, at least not until we break down at the very least below 1.1250 level, which is the previous resistance. If we break down below there, then I'll be watching to see what happens at the 1.11 level to see if it ends up being the floor. To the upside, I think the 1.15 level is a very serious and real target, but we may have to build up momentum occasionally on the short-term pullback in order to start buying and go long again. I have no interest in shorting this market anytime soon.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out