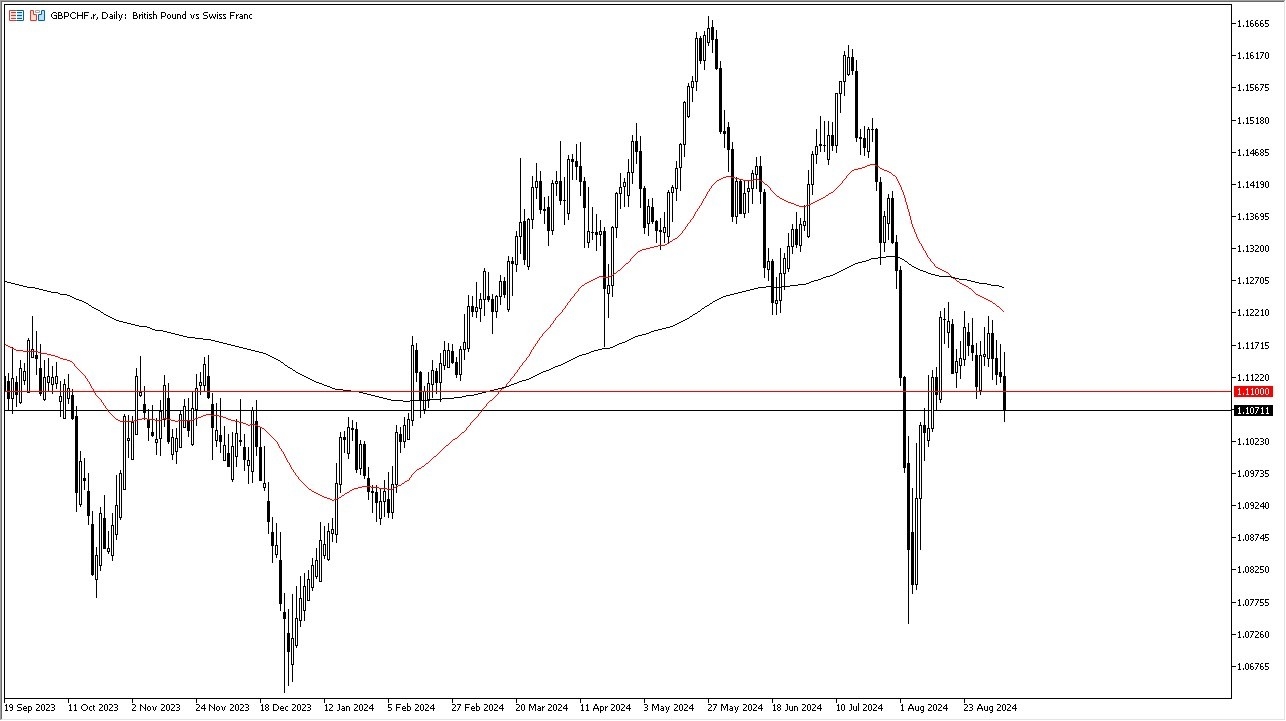

- On Friday, the British Pound initially tried to rally against the Swiss Franc, but we have broken back below the 1.11 level, an area that has been in support for a couple of weeks now.

- This is an area that previously has been important multiple times, so it's not a huge surprise to see that the market is paying close attention to it.

- However, at this point in time, if we can recapture that level, then it's possible that we could see the British pound try to get back to the 1.1220 level.

If we break down below the lows of the Friday session, then the next logical target will be the 1.10 level followed by the 1.08 level. This is a risk on or risk off type of situation. And if risk appetite starts to pick up, then the British pound tends to outperform the Swiss franc. However, at this point, I am not sure people know what to do.

Top Forex Brokers

Risk on or off?

With all of that being said, I think we've got a scenario where traders are looking at this through the prism of whether or not the global economy is slowing down. And it is. So, they are starting to run towards safety. Ultimately, though, this is a market that I think will continue to be very volatile. So, I'll be watching all of those levels in order to make my next trading decision.

You'll find that it will be difficult to hang on to a position for any significant amount of time because quite frankly, the markets are schizophrenic, and the computers are throwing things around again. Anytime we get something that isn't quite the norm, the markets flip out and that's because of automated trading. I think that continues to be the case and therefore you have to be very cautious. As of late, I've been trading about half the usual position size because quite frankly, it's not worth the nausea.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.