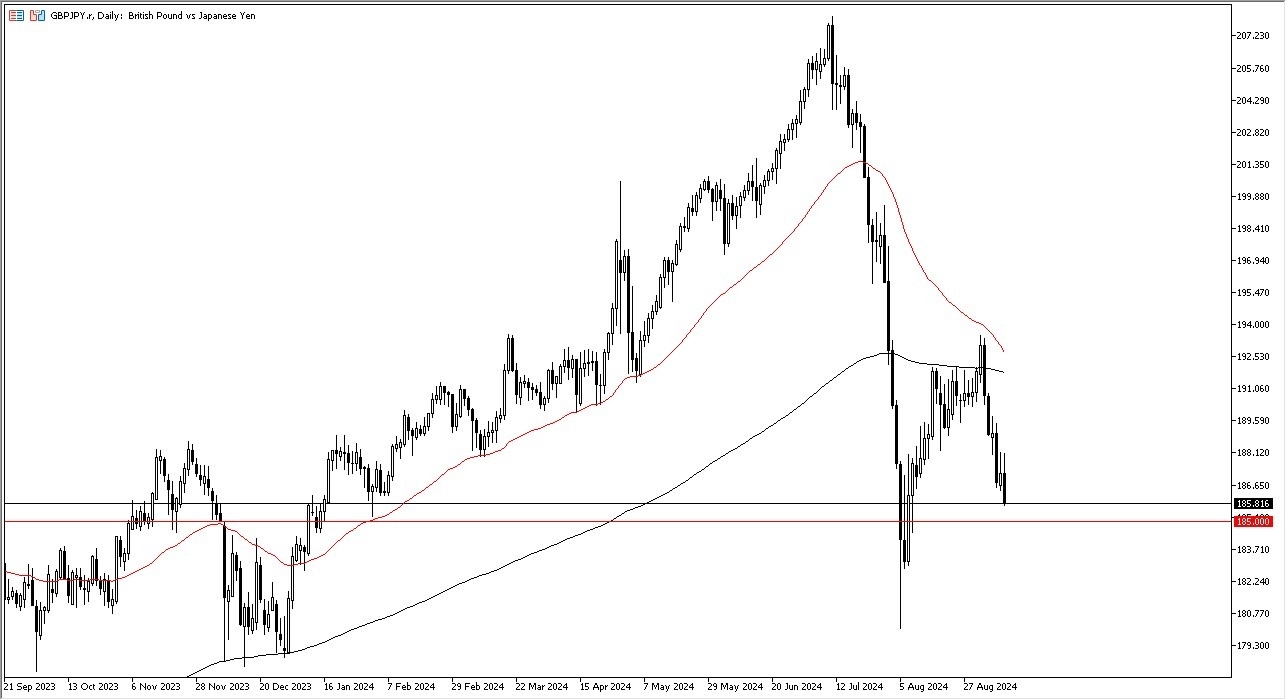

- We initially tried to rally during the early hours on Tuesday in the British pound against the Japanese yen, but then fell off of a cliff as we continue to see erratic and spastic behavior time and time again.

- That being said, I think you also have a situation where people are starting to get whether or not there is going to be any risk on or risk off behavior.

- Obviously, a safety trade would be to buy the Japanese yen.

- But I do think that the 185 yen level is a large round psychologically significant figure that a lot of people are going to be paying attention to.

If we turn around and break above the 188.50 level, then I think we could go higher, perhaps reaching the 200 day EMA. Anything below the 185 yen level really starts to get a bit scary, perhaps reaching down to the 182 level. In general, this is a market that I think is going to continue to be very volatile, and that doesn't do well for the carry trade because people don't want to hold that type of risk.

Top Forex Brokers

Caution is the better part of valor

In general, though, this is a situation where we need to just simply wait to see whether or not we get enough stability or if we continue to shake weak hands out. I don't like shorting this pair right now. I think we've fallen too far, but it's difficult to buy as well. I think if we can break above the highs of both Monday and Tuesday, then you can make an argument for going higher. But right now, it's all about trying to find the floor and that's generally a messy set of circumstances. Ultimately, I do think that it sooner or later we will get some type of clarity, but right now it's very difficult to make that decision, due to the fact that the markets continued to see so many different freak outs on an almost daily basis.

Ready to trade our daily Forex forecast? Here’s some of the best forex broker UK reviews to check out