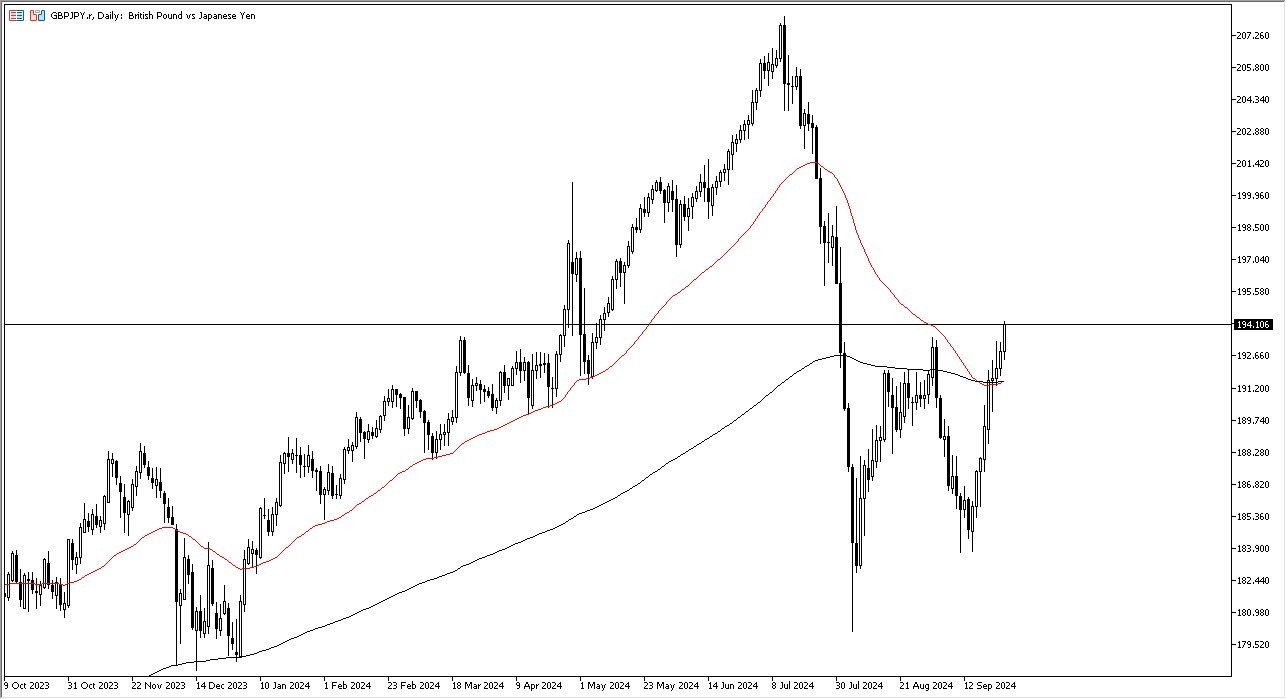

- During my daily analysis of the GBP/JPY pair, I noticed that we have broken above the crucial ¥194 level, and therefore I think we are getting ready to see a much bigger move.

- Short-term pullbacks of course are very well possible, but I think they will just be bought into as it offers a bit of value for traders to get involved with.

- In general, I think you have a situation where the carry trade is coming back into vogue, because even the US dollar is starting to rally a bit against the Japanese yen.

Bank of England

The Bank of England recently chose to sit Pat with its monetary policy, and therefore it does make a certain amount of sense that we have seen the British pound truly take off. Because of this, the market is likely to continue to see a lot of volatility, but I think given enough time we can open up the possibility of a move to the ¥197 level. The ¥197 level is an area where we have seen a significant amount of noise in the past, so I think that makes a reasonable target. Nonetheless, I think short-term pullbacks will continue to offer quite a bit of support, so a short-term pullback offers the possibility of a “buy on the dip” scenario.

Top Forex Brokers

The Bank of Japan has also decided not to raise rates again, so that means that the Japanese yen will probably continue to get sold off, and therefore I think we will eventually see the trading public in general continue to look at this as a market that you have to be a buyer of. I have no interest in shorting this market, at least not until we break significantly below the 50 Day EMA, and the 200 Day EMA indicators. Underneath there, we have the ¥190 level which I suspect is a major floor in this market overall. The market continues to see plenty of momentum, and therefore I think we continue to go higher.

Ready to trade our Forex daily forecast? We’ve shortlisted the best regulated forex brokers UK in the industry for you.