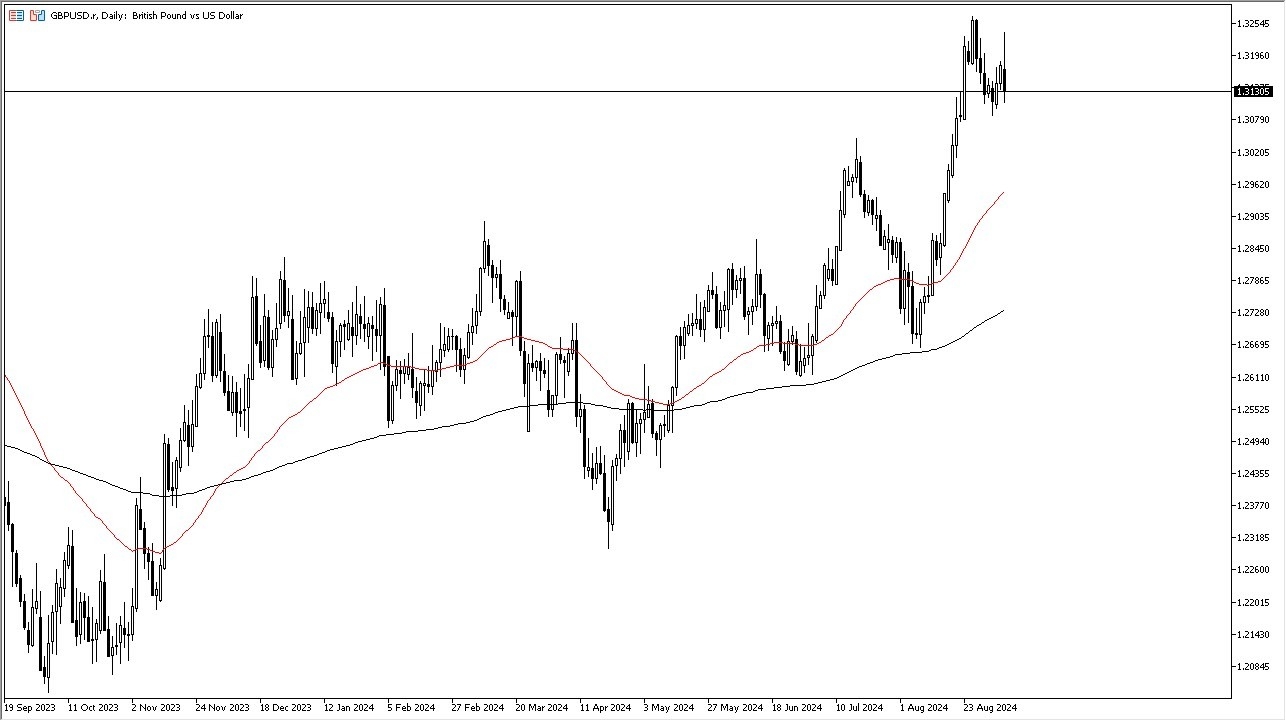

- You can see that the British pound initially rallied during the trading session on Friday, but then collapsed quite significantly to show extreme signs of weakness.

- At this point in time, the market is likely to continue to see a lot of uncertainty.

- With the jobs number in the United States coming out weaker than anticipated, that has people worried about the global growth situation. And of course, whether or not the trader is going to continue to chase risk, or will they run into something like the US bond market in order to protect their wealth?

That is a very real possibility, but we'll have to wait and see how that plays out. Keep in mind, this is a market that has been very, uh, bullish for some time. And we are now consolidating quite drastically. This suggests that the market will more likely than not continue to see the dips as potential buying opportunities, but if we really start to see panic take over the market, the US dollar is almost always a big winner.

Top Forex Brokers

A breakdown below the 1.3050 level opens up the possibility of a move down to the 1.30 level and then the 50 day EMA. In general, this is a market that I think continues to be very noisy and no matter what happens next, it is going to be a choppy affair.

If we were to break above the 1.3250 level, then the 1.35 level could end up being a target, which being a psychologically important large figure, it also could end up being a ceiling. We will wait to see if that ends up being the case, and as a result, I think this is a market that will remain volatile, but over the next few weeks, we should get a bit of clarity if the Federal Reserve can do its job of conveying their plans to the marketplace.

Ready to trade our GBP/USD daily analysis and predictions? Here are the best forex trading platforms UK to choose from.