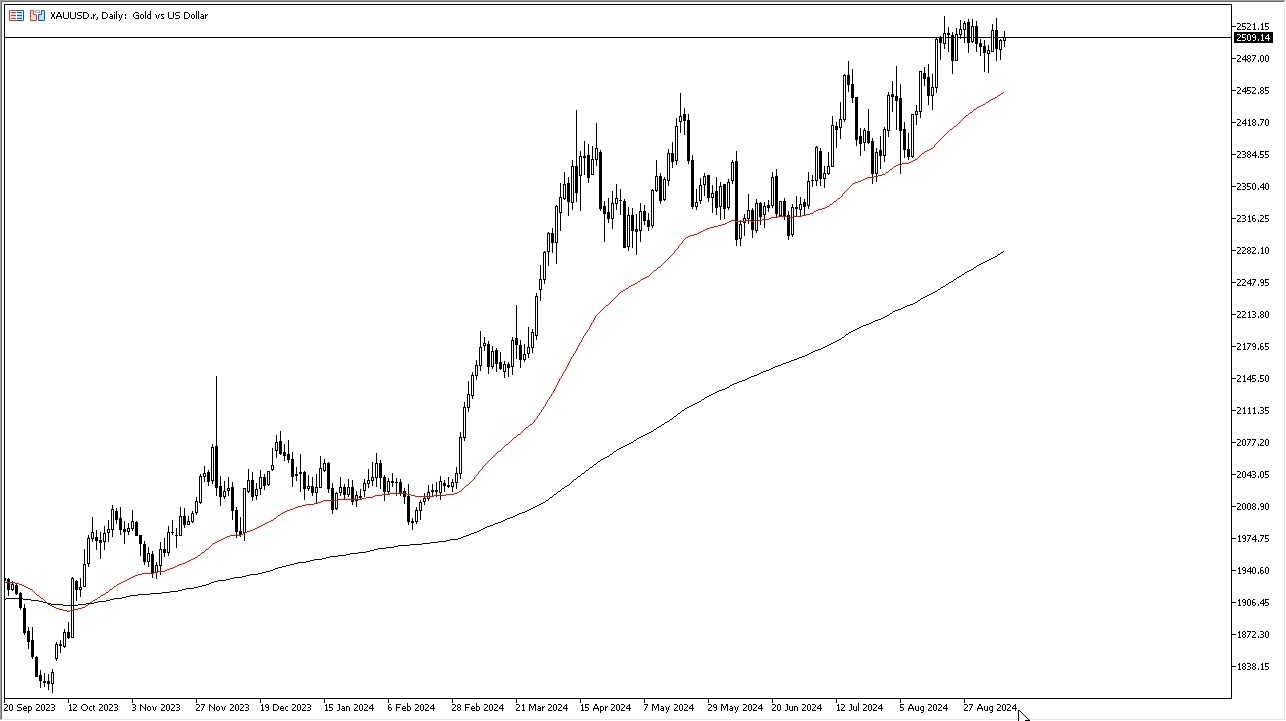

- The market has been consolidating for several weeks, and it certainly looks as if we are trying to do everything, we can to eventually build up enough momentum to go higher.

- We could be looking at a market that is going to be somewhat sideways between now and the FOMC announcement, which of course is on the 18th, meaning that people may be just simply peddling sideways in order to get into position for what could be one of the most important Federal Reserve meetings and announcements that we have seen in years.

Because of this, I think that gold has a certain floor underneath, because quite frankly people believe that the Federal Reserve is going to cut by 25 basis points at the very least, and some are even starting to talk about the possibility of a 50 basis point cut. While I don’t necessarily believe that the 50 basis point cut scenario plays out, at the end of the day, it doesn’t really matter because there are a whole host of reasons why gold should continue to go higher over the longer term.

Top Forex Brokers

Multiple Pressures to the Upside

There are multiple reasons to think that the gold market continues to grind higher, and the first one of course is the most obvious one: we are in a massive uptrend and have been for quite some time. Typically, markets tend to move in the same direction for long periods of time, and it does take a significant shift in attitude and fundamentals to change that.

Furthermore, this is a market that has a lot of support near the $2475 level, and while we have seen the $2530 level offer a significant short-term ceiling, it’s worth noting that every time we pull back, buyers jump back into the market to take advantage of it. Beyond that, you also have to keep in mind that the geopolitical situation around the world continues to be a bit of a mess, and that makes gold attractive.

However, and I believe that this is the most important reason, interest rates around the world are going to be dropping. As long as that’s going to be the case, that typically helps gold, as it negates the benefit of owning bonds over gold, because the storage fees become a lot less restrictive in relation to a small return on paper.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.