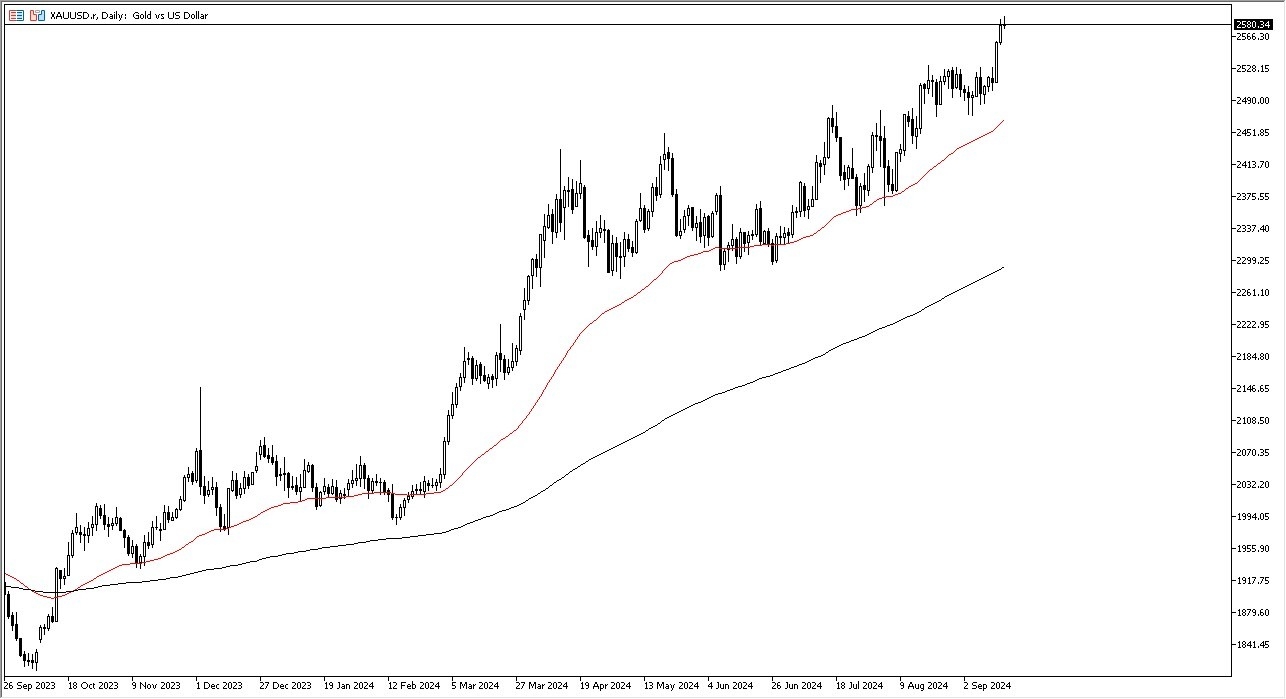

- Gold initially did try to rally a bit during the Monday session, but it looks like we are stalling a bit.

- That does make a certain amount of sense considering that we had gone straight up in the air for the last several sessions.

- Now this week we have to focus on central bank behavior and statements.

The FOMC meets on Tuesday and Wednesday and during the Wednesday session will give an interest rate decision, which I fully anticipate the Federal Reserve will cut by 25 basis points. So, I think the market has already priced that in. However, the real question is going to be what they choose to do afterwards. What will the press conference tell people in the question and answer portion?

Top Forex Brokers

It’s the Statement and Press Conference

There will be a statement that will be paid close attention to, but ultimately, I do think that gold goes higher for a whole litany of reasons. It's not just the Federal Reserve. Central banks around the world are cutting rates and we have the Bank of England and the Bank of Japan both in the next couple of days after that, more likely than not going to move the markets.

I believe gold will be in focus during those sessions, especially with ongoing geopolitical concerns making it an attractive option. With uncertainty surrounding global conflicts and limited incentives for taking on significant risk over the long term, gold remains appealing as a safe haven. The question now is whether or not geopolitics also adds to the gold market. And I think it does. Quite frankly, we have a lot of conflict around the world right now, and a lot of potential for further conflict. So, with all of these things being tied together, and the fact that we're in an uptrend anyway, I think dips continue to get bought into when it comes to the gold market.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.