- The gold market has pulled back just a bit during the course of the trading session on Tuesday, as traders are looking at the market through the prism of whether or not the Federal Reserve will cut rates, or perhaps more importantly, whether or not they are going to be very dovish in the press conference.

- I think at this point in time it makes quite a bit of sense that the 25 basis point cut is essentially priced into the market, so with that being said, the move will probably have more to do with what Jerome Powell has to say after the fact.

Technical Analysis

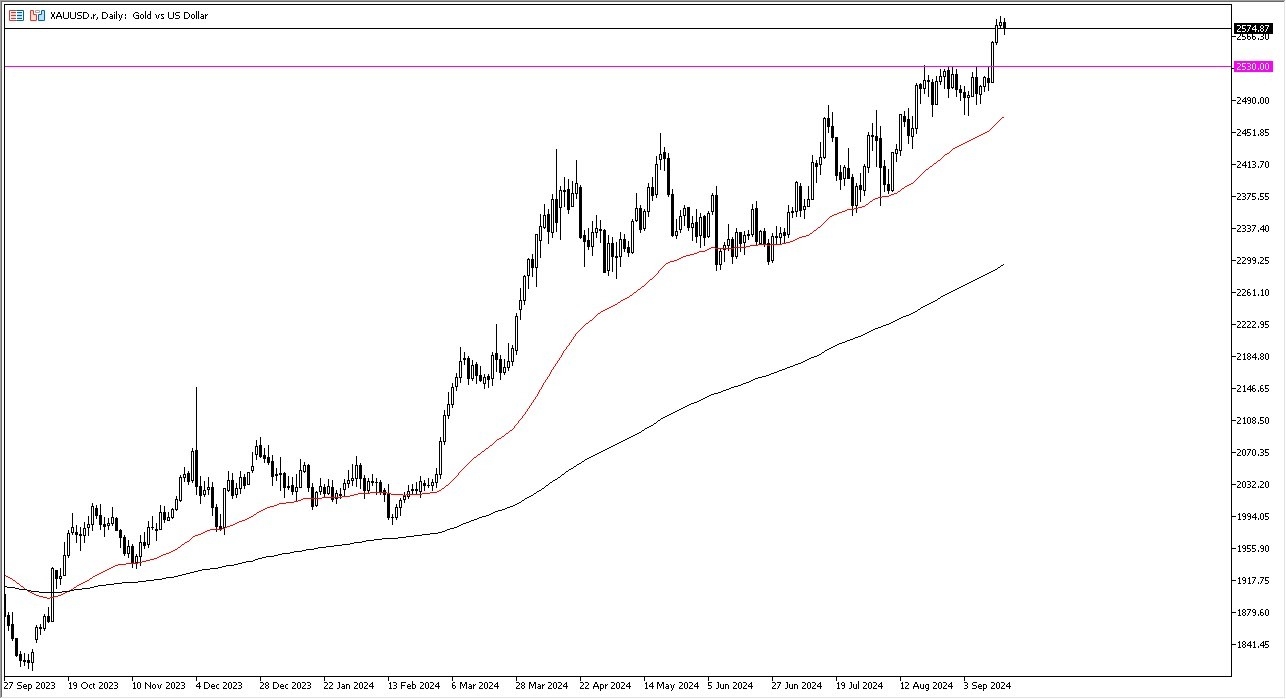

The technical analysis for this market is very bullish, but it does look like in the short term we may have to pull back a bit in order to find some value. The $2530 level is an area that previously had been significant resistance, and therefore I think it makes a certain amount of sense that we would see “market memory” come into the situation, offering a significant amount of support on a pullback. Quite frankly, I would love to be able to buy gold near that area, but we will have to wait and see whether or not that happens.

Top Forex Brokers

Even if we were to break down below that level, the 50 Day EMA sits right around the $2475 level, and is rising. This is a major indicator for technical traders, and therefore I think we’ve got a situation where the indicator could offer quite a bit of support. All things being equal, I think we are in the long-term uptrend for reason, not the least of which would be the Federal Reserve. However, we also have plenty of geopolitical concerns around the world, as the conflict in the Middle East continues to be a major driver, but then again, we still have a lot of concerns in Ukraine. Furthermore, central banks around the world continue to hoard gold, and I think that gives us a situation where the uptrend should continue given enough time, and that dips continue to be buying opportunities.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.