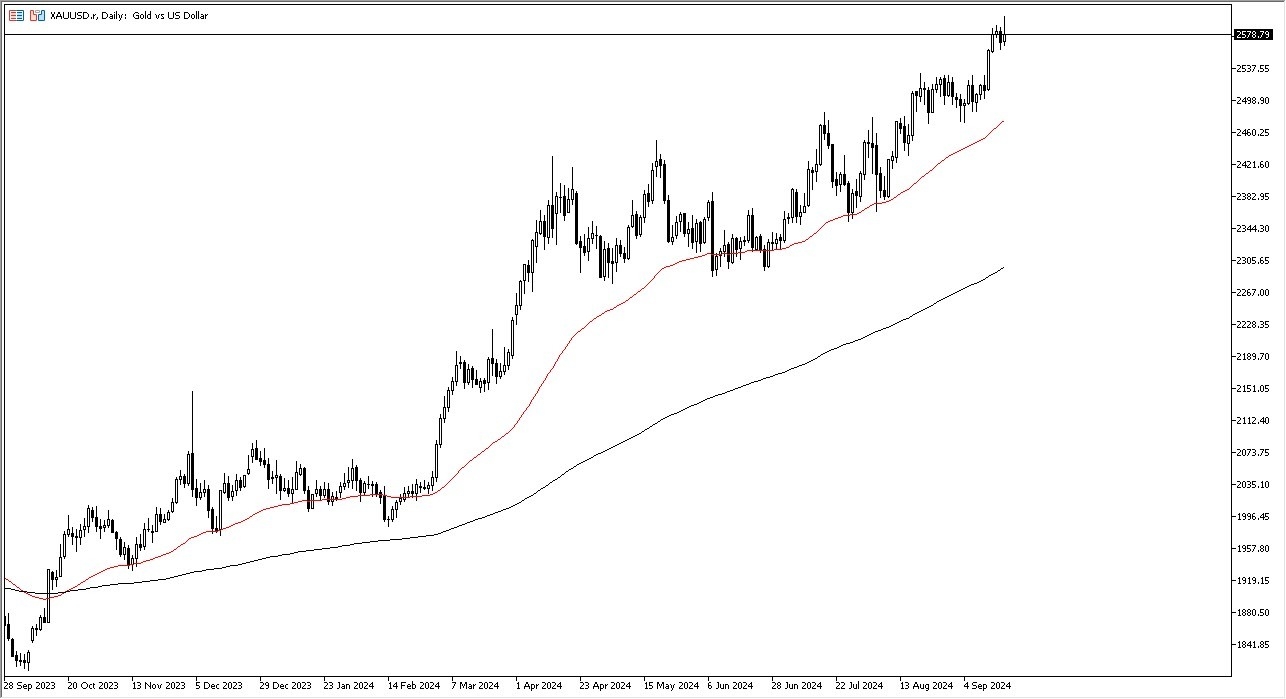

- The first thing I see is that we had broken out to the upside, especially as the Federal Reserve had cut interest rates by 50 basis points in the afternoon.

- That being said, there are a lot of questions as to what this means, because while the market is looking at the interest rate cut as a potential positive, the reality is that the market also could look at this through the prism of a potentially negative turn of events, because they will ask the question “What does the Federal Reserve know and believe is going to happen next?”

After all, this is a pretty aggressive rate cut, especially considering that the economy is “fine”, and with that being the case, it could make a lot of sense that we would see traders start to question whether or not they are worried at the Federal Reserve. We have seen this play out before, when the interest rate cut was a little hotter than anticipated, generally at the point of major concern when there are questions about whether or not the economy is about to enter a major recession.

Top Forex Brokers

Technical Analysis

I certainly believe that gold is more positive than negative, and I also recognize that it needs to pullback a bit in order to offer value. Perhaps it has already done that during the session after the initial “knee-jerk reaction” to the upside, but ultimately, I think this is a situation where at the very least we need to go sideways in the short term, perhaps even pull back in order to offer enough value worth taking risks with. I certainly would not short this market, it is far too strong, and I do believe that it is probably only a matter of time before we break well above the $2600 level.

Furthermore, the Bank of England has an interest rate decision on Thursday, and of course the Bank of Japan has an interest rate decision coming out on Friday. In other words, there are plenty of central banks out there that could continue to cut rates, driving hard assets higher.

Ready to trade our Forex daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.