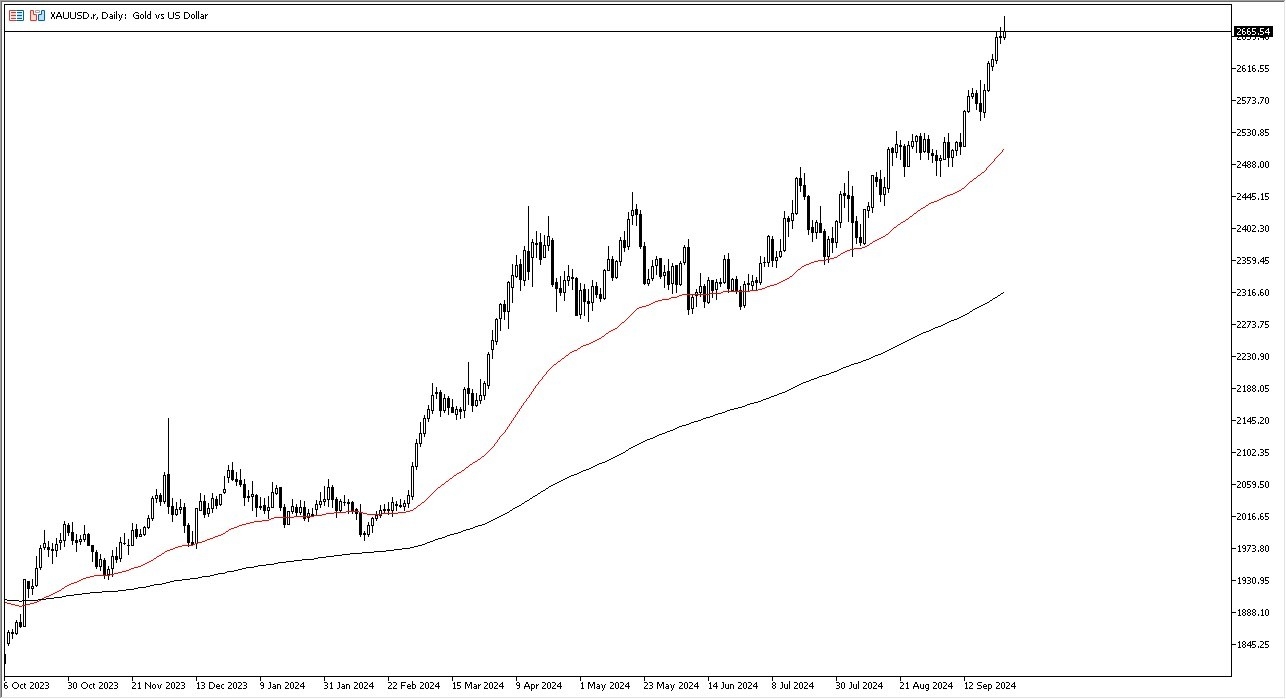

- The gold market initially rallied during the trading session on Thursday but started to show signs of exhaustion again.

- I do think we're getting to the point, quite frankly, that it's only a matter of time before gold pulls back.

- The relative strength index, of course, is in an overbought condition.

So, a little bit of a correction probably makes more sense than not. And although I am extraordinarily bullish on gold, I also recognize it can only go in one direction for so long. There will need to be a little bit of profit taking or perhaps a little bit of a pickup in the US dollar, because quite frankly, that has been sold off quite drastically as well, and you have to keep in mind that, again, markets don't move in one direction forever. That includes the US dollar falling. That being said, I see several areas where we could see support, the first one being the $2,600 level. But after that we have the $2,530 level, an area that previously had been resistance, and there should be a certain amount of market memory attached to it.

Top Forex Brokers

I Won’t Short Gold No Matter What

I don't short this market, not in this environment. With interest rates dropping around the world, the Federal Reserve seemingly cutting rates rapidly, and of course, the geopolitical concerns. Beyond that, you also have banks in Asia, especially going out and buying the bullion to shore up monetary reserves in countries like Russia, China, India, Indonesia, some others.

So, with all of that being said, there are far too many things working for gold to try to short it. On the other hand, if we do get a somewhat significant pullback, I'm more than willing to jump in and start buying this asset. The markets will continue to see a lot of demand, especially as the market has seen such a massive amount of interest as of late.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.