- The gold market continues to see a lot of volatility but on Friday we saw the profit taking take over the overall attitude.

- I think at this point you have to look at this through the prism of finding value underneath.

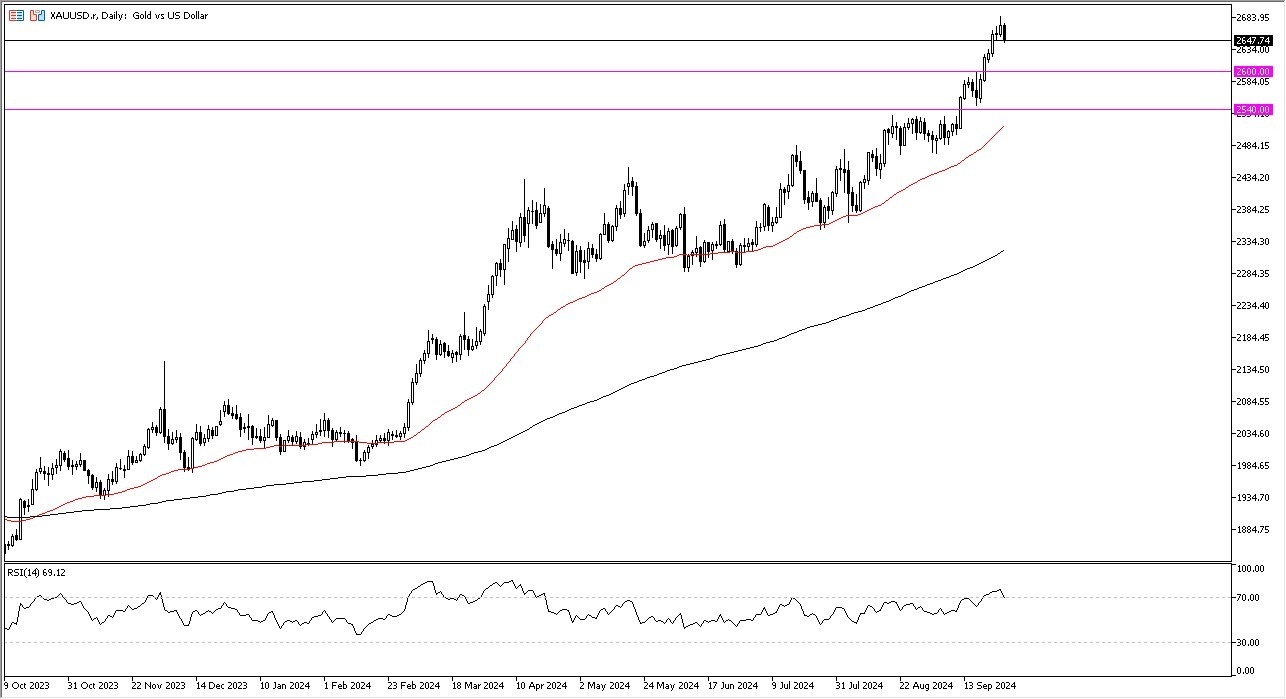

- I would be very interested in buying gold near the $2,600 level, which is a large round important number, that a lot of options traders are probably paying close attention to.

If we were to break down below there, then the $2,540 level where the 50-day EMA is probably going to intercept price. All things being equal, this is a market that I don't have any interest in shorting, and it does make a certain amount of sense to bring up the fact that the Relative Strength Index is now in the overbought area, and it looks like it's trying to pull back as well.

Top Forex Brokers

Maybe it was just a Friday session?

All of this lines up perfectly with Friday trading. Traders don't want to be caught in an overextended position and take losses first thing when we open up on Monday. I do think that you will get an opportunity to buy gold at a lower price and at a value. With this being said, I'm waiting for the $2,600 level or some type of pullback, and I have no interest whatsoever in shorting this market as it will continue to be strong due to geopolitical events, interest rates dropping around the world, and of course central banks in the east buying gold itself.

All things being equal, there are plenty of reasons to believe that the geopolitical situation alone will continue to drive going higher, but quite frankly there are many other things out there that could as well. Keep an eye on the news, because I think it’s probably only a matter of time before something flares up and has a bit of “panic buying quote in this market. If not, I will just simply find value and take advantage of it as it occurs.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.