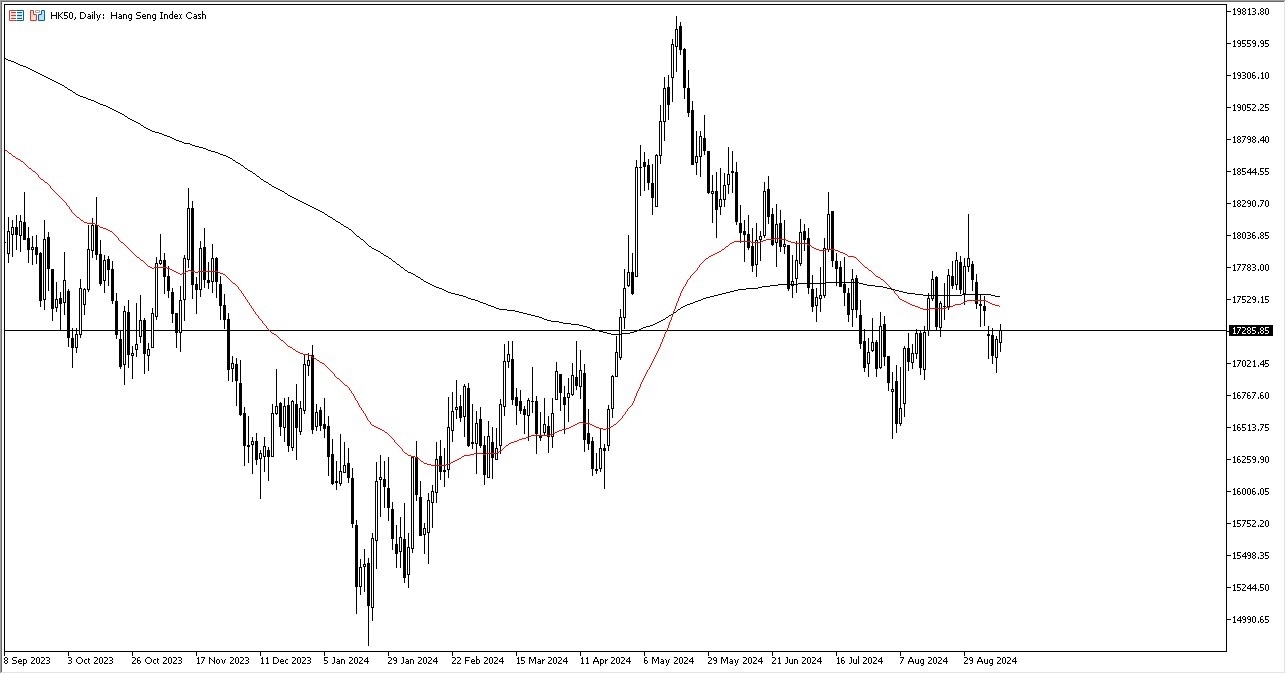

- As you can see, the market rallied quite a bit in the early hours on Thursday. And now as we head into Friday, it looks like we're going to try to fill the gap from the beginning of the week.

- That could have this market reaching towards the 17,550 Hong Kong dollars level where the 50-day EMA currently resides.

- There are a lot of questions about risk appetite, but I would point out that from a technical analysis standpoint at least, it looks like the 17,000 region is going to continue to be important.

We have in fact bounced directly from that area in the early part of the week. This could set up a move towards the 18,000 level, perhaps higher than that, but really at this point in time, I think there are a lot of questions asked about the global economy.

Top Forex Brokers

Technical Analysis

From a technical analysis standpoint, it would make a certain amount of sense to bounce around in the 1000 Hong Kong dollars region. We have the 50 day EMA and the 200 day EMA both. Very sideways and it suggests that we don't really have anywhere to be. If we can break above 18,250 Hong Kong dollars, then I think this is a market that probably goes much higher, perhaps reaching towards the 19,600 Hong Kong dollars level. If we were to turn around and drop down below the 17,000 Hong Kong dollars level, then the 16,500 Hong Kong dollars level, uh, gets targeted as it was a major swing low.

Ultimately, this is a play on China, and questions arise as to whether or not China’s slowing down, but it’s also worth noting that the entire growth picture may change completely as central banks around the world continue to adopt liquidity measures. While the Chinese economy has been a bit of a laggard, the reality is that traders will continue to try to focus on liquidity pushing stock markets higher in general.

Ready to trade our Forex daily analysis and predictions? Here are the best Asian brokers to choose from.