- The IBEX had initially tried to rally during the trading session on Tuesday but gave back the gains as it looks like we are running out of momentum.

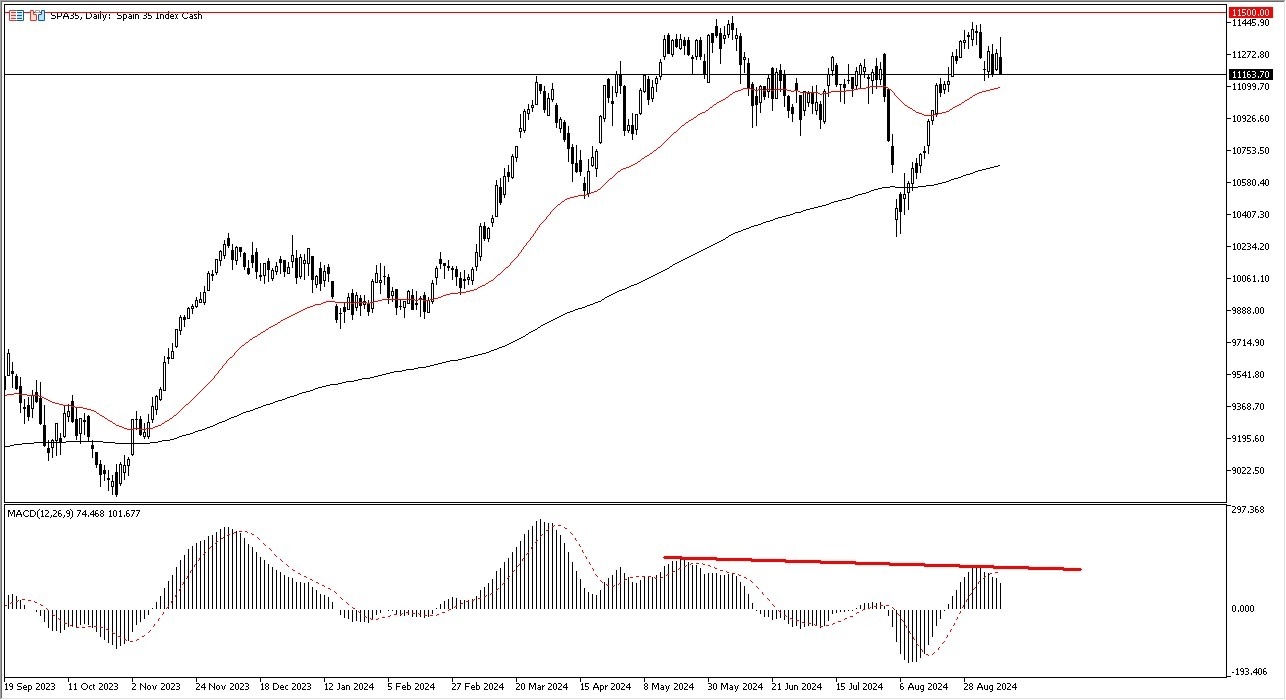

- This is interesting because we could be in the midst of trying to form some type of double top with an eye on the 11,500 euros level.

- We are sitting just above the 50 day EMA, so that of course is something worth paying attention to.

But if we were to break down below there, I think it brings even more downward momentum into this market in that environment. The market goes looking to the 200 day EMA, which is closer to the 10,660 level.

Top Forex Brokers

Anything below there then confirms a downward move, it just waiting to happen. Now, that being said, I think you've got a situation where you should also pay attention to the fact that the moving average convergence divergence indicator is now showing a bit of divergence. And that is also another sign that maybe we are running out of steam.

The role of the IBEX 35

The IBEX in Spain is considered to be a little riskier than some of the other European indices. So, take that for what you will. But if risk appetite is starting to fall apart, then that means that Spain won't attract the inflows that it does in a market that is highly aggressive looking for returns.

This is a very important market to watch for the rest of Europe, so we'll see how it plays out. If we were to break above the 11,500 euro level, that would obviously be very bullish, but right now it doesn't look like we're anywhere near attempting that, at least not in the short term. With this being the case, the market is very likely to continue to see a lot of uncertainty, but if we do start to see Spain fall, it could very well drag the rest of the European Union with it as the indices tend to move in lockstep over the longer term.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.