- We have a lot of confusion. That’s not a huge surprise, considering just how nasty the selloff was on Friday, and the fact that we had an almost equally impressive rally on Monday.

- At this point, the market will have to determine whether or not it feels “comfortable” hitting long of this market.

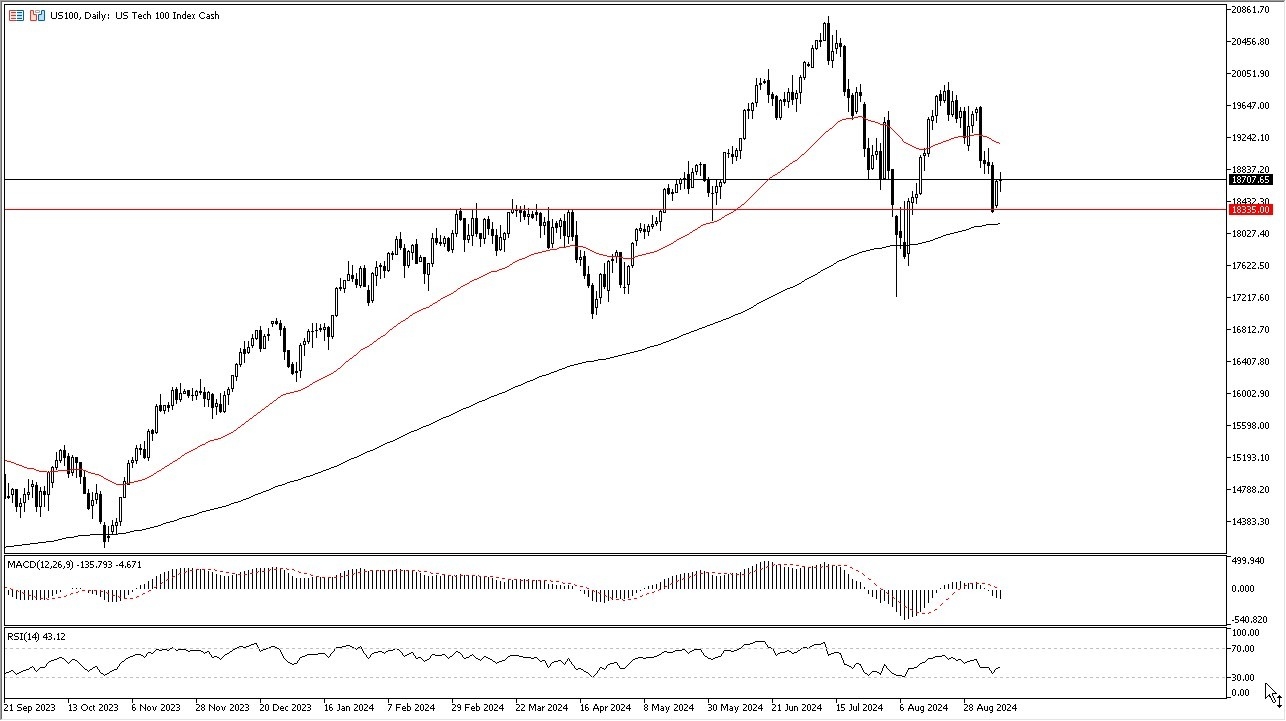

- It’s worth noting that the 18,335 level offer significant support, and that of course is backed up by the 200 Day EMA underneath, which of course is an indicator that a lot of technical traders pay close attention to.

It is also worth noting that the most recent swing high was lower than the one before it, something that we haven’t seen in a while. I do think that there are a lot of underlying concerns in the global economy that could weigh upon stocks in general, and of course the NASDAQ 100 is one of the more volatile indices that US traders get involved with, so it does make a certain amount of sense that people might be a bit nervous about throwing a ton of money into this market. In other words, I don’t think the volatility is going anywhere.

Top Forex Brokers

Federal Reserved

The Federal Reserve cutting rates on the 18th of course has everybody excited, but the question then becomes “why are they cutting rates?” If they are cutting rates to engineer some type of soft landing, that will make everybody happy. However, if they are starting to become concerned about the US economy, that is an entirely different argument altogether. That of course has people very concerned, and they will take risk off the table, including technology stocks which are notoriously noisy to begin with.

All things being equal, I think this is a market that goes somewhat sideways in the short term, perhaps with a slightly upward bias. Whether or not we can break the latest swing high to the upside remains to be seen, because it certainly looks as if the 20,000 level is an area that the sellers are very interested in. I suspect that we probably won’t have any clarity until after the Federal Reserve gets involved, at least for a longer-term move.

Ready to trade the daily forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.