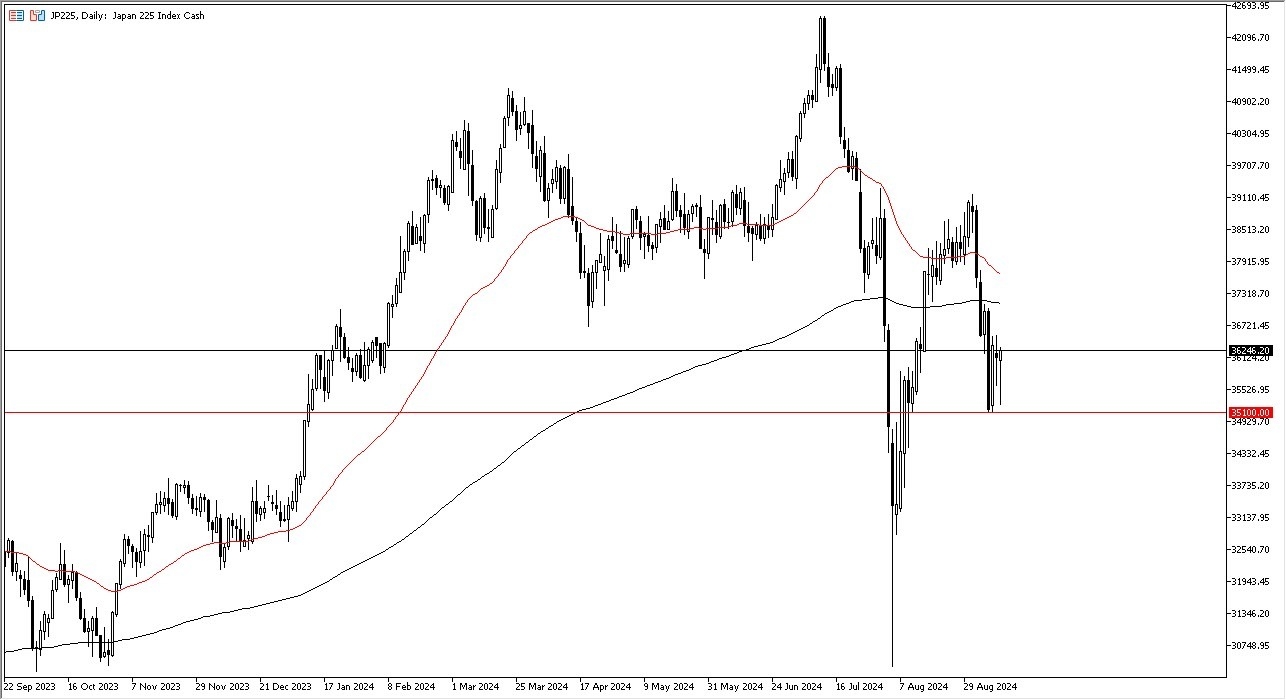

- The Nikkei 225 initially pulled back during trading on Wednesday to reach down towards the 35,100 yen level.

- This is an area that's been important multiple times over the last couple of weeks.

- So it does make a certain amount of sense that we would see buyers here.

If the market can maintain this level, it's possible that we could make a move towards the 200 day EMA, which is currently right around the 37,300 yen level. Anything above there then has the market looking much more bullish. That being said, keep in mind that the Japanese yen is a major influence on what happens in this index as most of the companies in the Nikkei 225 are exporters and they need to be able to sell their products overseas.

Top Forex Brokers

Cheap Exports and Japan Go Hand in Hand

Therefore, they need the Japanese yen to be somewhat cheap, and that's been the game for about 25 to 30 years now. As the Japanese yen initially strengthened, the Tokyo stock market began to fall. However, when the yen weakened, yen-denominated pairs rebounded, and the Nikkei 225 followed suit, reversing its earlier losses.If that does in fact continue, then we could see this market start to outperform again, like it did so many months ago. I do expect a lot of volatility, and I do expect a lot of uncertainty. So, I'd be very cautious with my position sizing, but I also recognize that we may be at a major point of inflection here.

With all of this being said, keep in mind that the Japanese central bank has an interest rate decision on September 20th, and that will have a major influence on what happens next not only in this market, but also the Japanese yen itself. I believe at this point in time, we've got a scenario where there are a lot of questions to be asked.

Ready to trade the daily stock market analysis? We’ve made a list of the best online CFD trading brokers worth trading with.