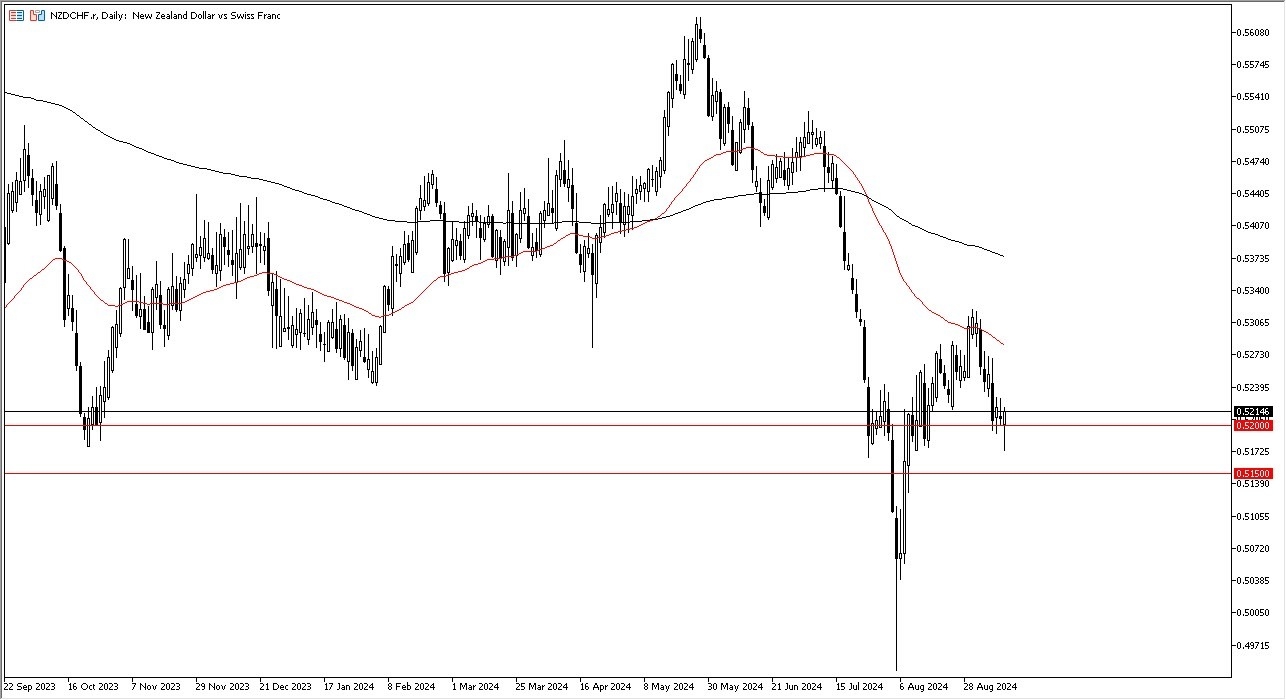

- The New Zealand dollar initially pulled back against the Swiss franc in the early hours on Wednesday, as we saw more of a risk off type of move.

- That being said, we have turned around quite nicely, and it looks like the risk appetite is trying to return to the marketplace.

- If we do break above the 0.5250 level, then we could see a little bit of momentum enter the market.

It could send this market looking to the 50 day EMA breaking above that level then opens up the possibility of a much bigger move just waiting to happen perhaps all the way to the 200 day EMA on the other hand if we were to turn around and start falling I think that a move below the 0.5150 level would be extraordinarily negative and it would certainly show that it's more of a risk off type of market.

Top Forex Brokers

The Behavior of the Kiwi Dollar

Keep in mind that the New Zealand dollar is highly sensitive to commodities and Asian growth while the Swiss franc is considered to be a safety currency. In other words, it will rise and fall with the overall attitude of markets around the world and risk appetite by traders. I do expect this to be a very volatile pair, but it is worth noting that we recently had a massive bounce in this pullback. Although somewhat sharp, It is just a blip on the radar from what we had seen in the previous bullish behavior over the few past weeks. If you put up a Fibonacci retracement level, you can see that we had bounced from the 38.2% Fibonacci retracement level. So now we're going to have to wait and see if the trend itself continues to go higher or if we have a complete breakdown.

Regardless, this pair can be very volatile, so you need to be cautious with your position sizing. I would not get into a massive position until the market starts to move into your favor, but keep in mind that the interest rate differential does certainly favor the New Zealand dollar over the Swiss franc.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.