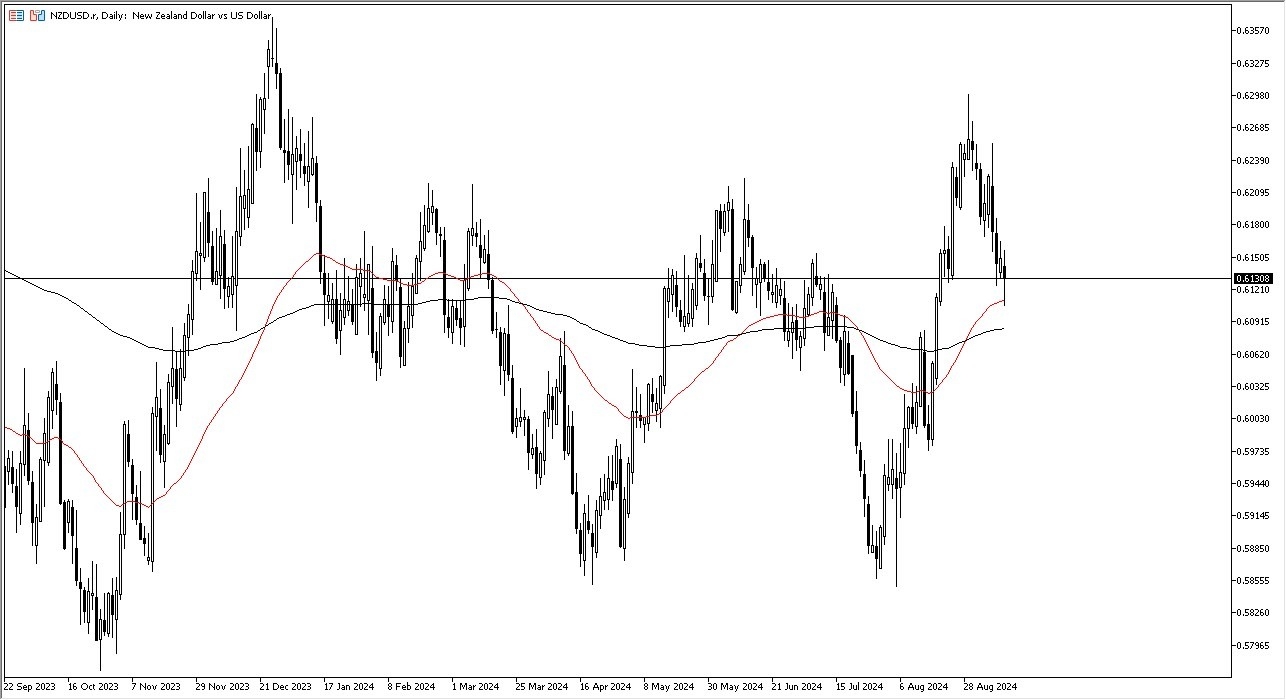

- The New Zealand dollar fell initially during the trading session on Wednesday only to turn around and show signs of life.

- It's worth noting that the 50 day EMA has offered a certain amount of support near the 0.61 level.

- I think this is a situation where we are looking at this through the prism of a market that is trying to recover from pretty negative behavior.

This is a market that is highly sensitive to risk appetite and of course, what's going on with the Asian economy and the global economy as a whole. Keep in mind New Zealand since most of its exports into Asia, although it does send some of its agricultural exports around the world. So, you need some type of positive behavior to get this market going to the upside.

Top Forex Brokers

On the other hand, if we do break down from here, then the 0.6980 level is backed up by the 200 day EMA. Breaking down below there then opens up a move much lower. In general, this is a market that I think continues to see a lot of volatility, which is nothing new. But that also being said, it's also worth noting that the US dollar is considered to be a safety currency, so we continue to see a lot of risk off behavior. This market will break down.

If We Move Higher

To the upside, the 0.63 level is an area that a lot of people have paid attention to multiple times. And I think what we have is a situation where we could see this market try to reach that level. But we need to see a lot of markets really take off to the upside as far as risk appetite is concerned to make the New Zealand dollar appealing enough for people to risk with it, and start shorting safety currencies such as the US dollar and others in its same category.

Ready to trade our daily Forex forecast? Here’s some of the best New Zealand forex brokers to check out.