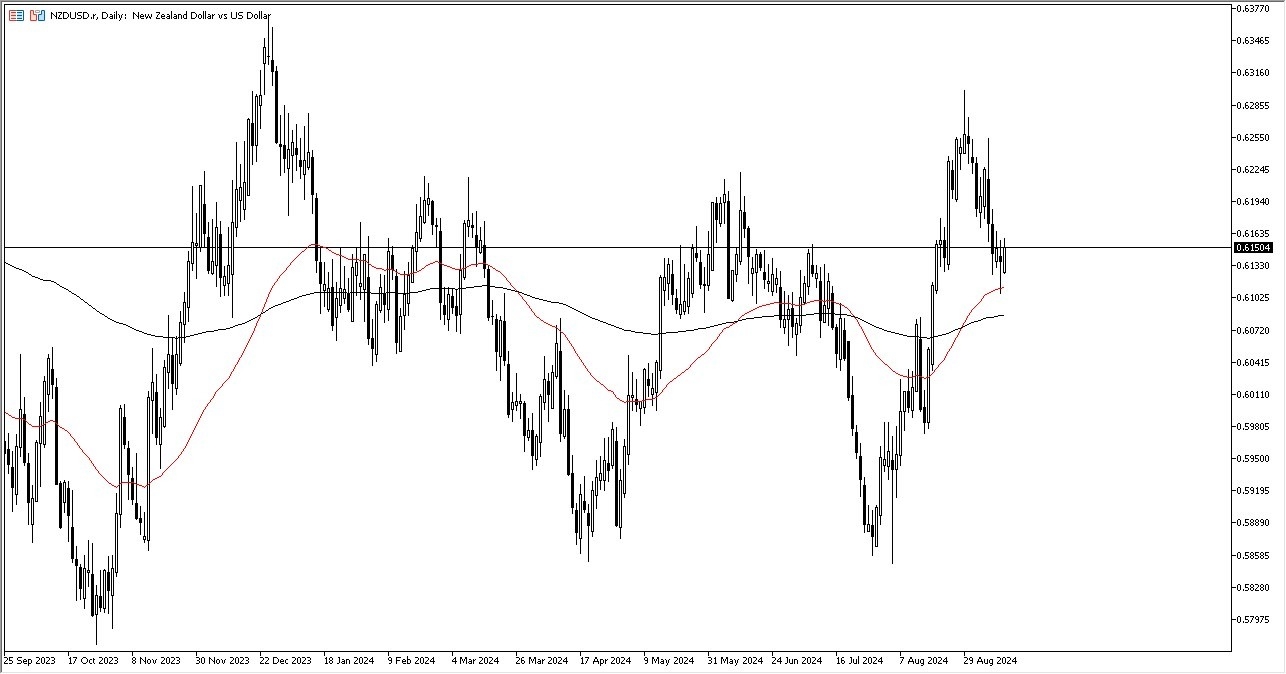

- During my daily analysis of currency markets, the New Zealand dollar has caught my attention during the trading session, as we have bounced from the 50-Day EMA, an indicator that a lot of people will be paying close attention to.

- The 0.61 level looks very likely to be a bit of a short-term floor in the market, and the rally that we have seen during the session on Thursday, as the market is constantly looking for the risk appetite out there, and of course risk appetite is in flux to say the least.

In general, I don’t have any interest in shorting this market, and I do recognize that the 200-Day EMA, currently sitting right around the 0.6070 level, continues to offer a certain amount of support, as the market is likely to continue to see a lot of interest in that area. After all, the market is likely to continue to see a lot of volatility, but it is worth noting that recently we had shot straight up in the air, only to pull back and show signs of life again. Now that it looks like we are ready to go higher from here, the market is more likely than not going to continue to see a lot of questions asked about whether or not the New Zealand dollar can continue its upward trajectory. At this point, it certainly looks like we are trying to sort out whether or not things are about to get better, or we are about to see some type of global recession.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is bullish, especially as the 50-Day EMA has offered support. The fact that we have turned around and show signs of strength is a good sign that perhaps the overall uptrend should continue, but I also recognize that the 0.63 level above is a large, round, psychologically significant figure, and an area where we would more likely than not continue to see quite a bit of resistance, so I think it makes for a decent target if we continue to have more or less a “risk on market” overall.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.