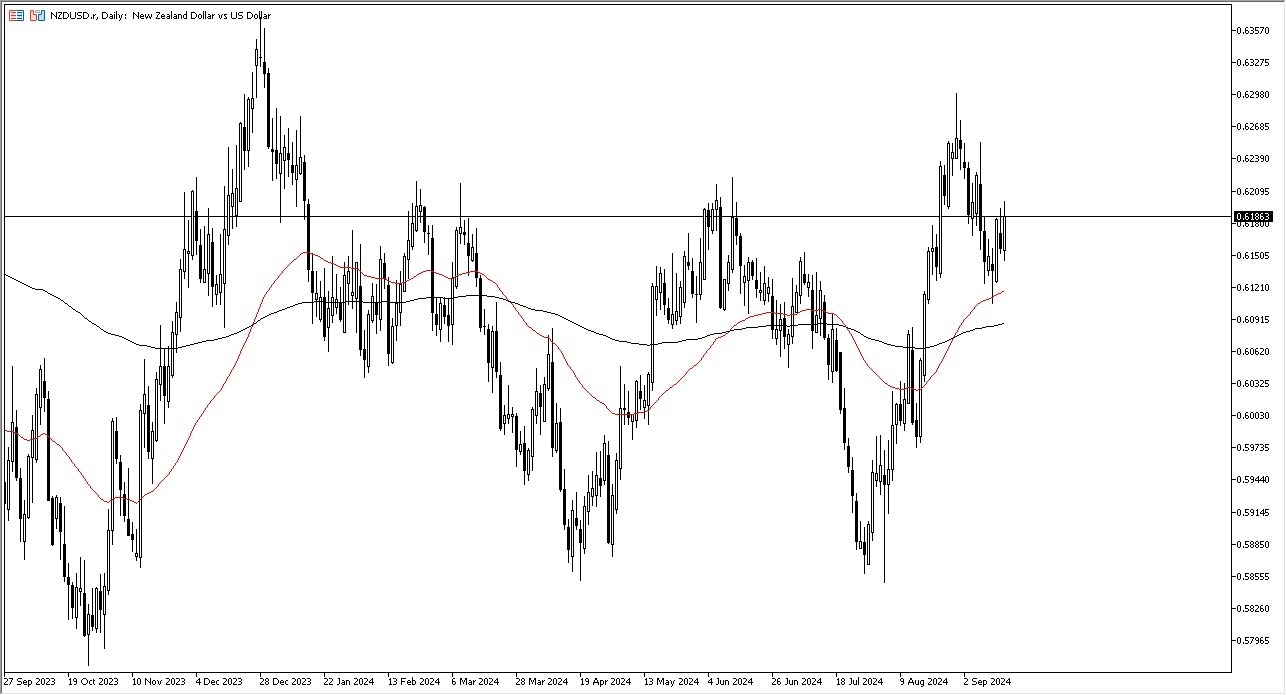

- The first thing I see is that this asset has rallied quite nicely, but it is still very much in a range that is somewhat well-defined.

- At this point, you can make an argument that we are in the midst of consolidation, or perhaps we are in the midst of a bullish flag.

- With that being the case, I am paying close attention to the 0.62 level, which of course is an area that previously has been of interest more than once, and with that being the case, I think you’ve got a scenario where if we can get above there, I anticipate that traders will continue to try to push this market to the upside.

All things being equal, the technical analysis is somewhat bullish, but we also have to pay close attention to the fact that there are a lot of uncertainties out there, and of course we have the Federal Reserve and its FOMC meeting, as well as the interest rate decision and press conference that will have a major influence on what happens next with the greenback. The New Zealand dollar of course is highly sensitive to the risk appetite, which is all over the place at the moment but in the short term it certainly looks as if people are willing to bet on the Federal Reserve becoming extraordinarily dovish.

Top Forex Brokers

Technical Analysis

The technical analysis for the NZD/USD currency pair is somewhat bullish, but it does look like we are going to get a bit choppy in this general vicinity. The most important thing at this point in time that I see on the chart is the hammer on Thursday of last week that bounced from the 50 Day EMA indicator, which is right around the 0.61 level. This is a sign that there are plenty of buyers, the question at this point is whether or not we can get some type of momentum? In general, I think we’ve got a situation where we continue to see a lot of uncertainty, but perhaps with a bit of a proclivity to go to the upside.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.