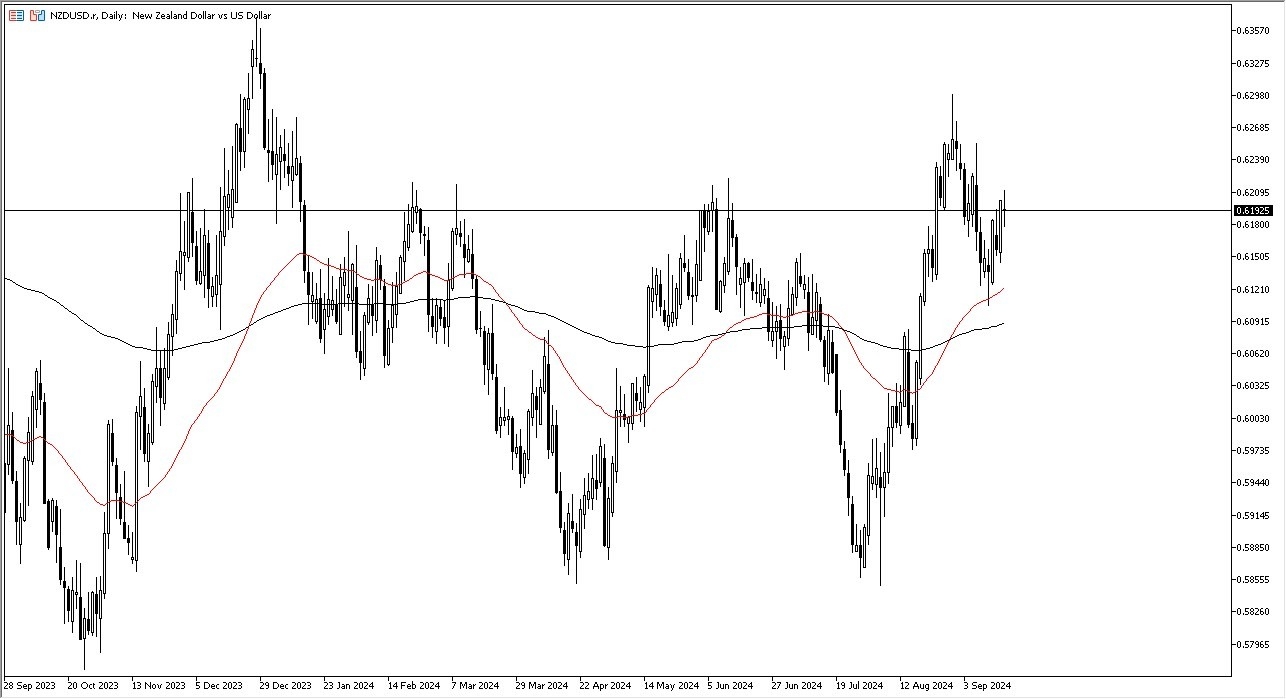

- It’s obvious that we are struggling a bit to find some type of directionality, which makes quite a bit of sense considering that the FOMC meeting and interest rate decision comes out on Wednesday, but perhaps more importantly, the press conference of course is something that will be widely followed.

- If Jerome Powell sounds extraordinarily dovish, that could really put a lot of downward pressure on the value of the US dollar in general, and therefore give the New Zealand dollar a little bit of a boost.

On the other hand, if he is not dovish enough, then you could see the US dollar strengthening, perhaps sending the market down to the 0.6125 level, which is basically where the 50 Day EMA currently resides. When you look at the chart, you can make an argument for a little bit of a bullish flag, but it is a bit on the sloppy side, so I don’t know that I like the idea of trying to trade the bullish flag concept.

Top Forex Brokers

The next 48 hours

I believe at this point in time, the next 48 hours will be crucial when it comes to the NZD/USD pair, as well as many other ones as the FOMC interest rate decision and of course the press conference will give us a huge “heads up” as to what’s going on with the US dollar, but it could also give us a bit of a sign as to where the risk appetite of the global markets will go. After all, if the Federal Reserve sees a lot of bad signs going forward, that could have a bit of a reverse reaction than what most people would expect. After all, if we are going to see everybody running for safety, it does make a certain amount of sense that the US dollar would give a bit of shelter for a lot of traders worldwide. On the other hand, if we get more “risk on”, the New Zealand dollar is an excellent vehicle for that.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.