- The New Zealand dollar has shot higher against the US dollar during early trading on Thursday as traders continue to react to the Federal Reserve cutting interest rates by 50 basis points on Wednesday.

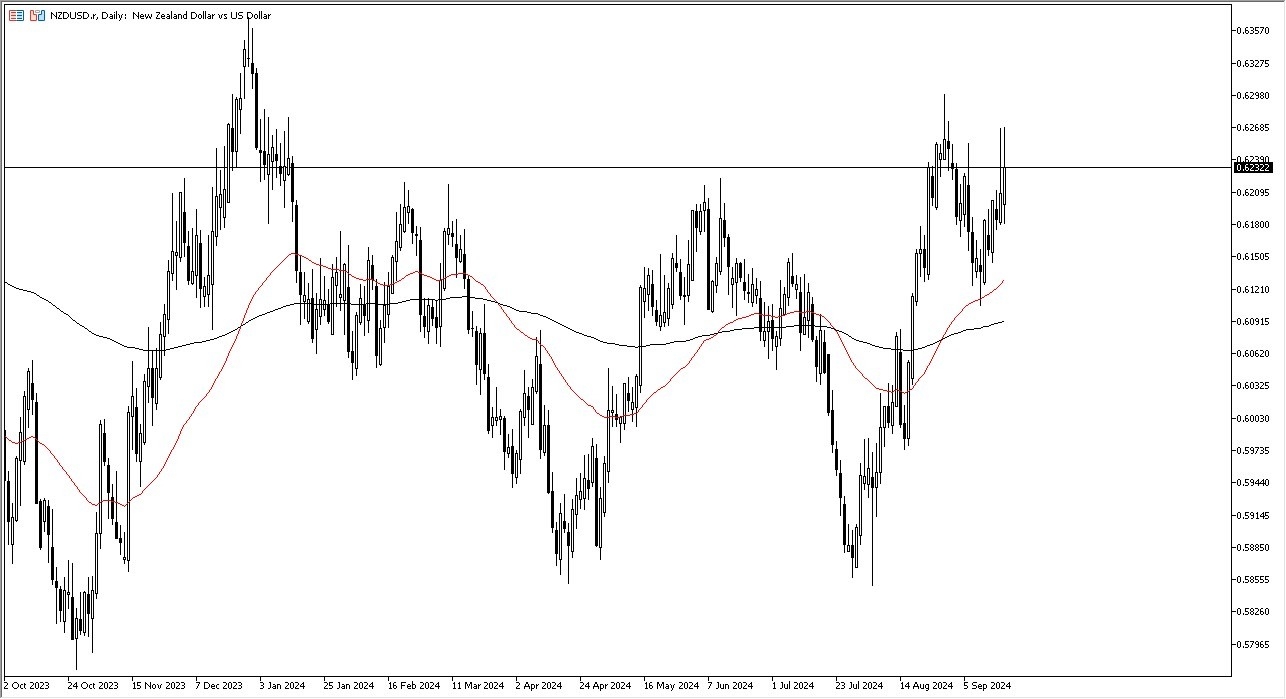

- The question now is whether or not we can continue to see upward momentum or if we are going to continue to struggle with the 0.63 level.

- This of course is an area that people will be paying close attention to.

I suspect it's probably a little of both in this market, because the NZ dollar of course is highly sensitive to risk attitude and appetite, so you have to see whether or not markets are choosing to rally on the whole. If they are, then that should help the Kiwi dollar. The 0.6350 level needs to be overtaken to the upside in order to become extremely bullish, and because of this, I think right now, most traders are looking at this as a short-term buy-on-the-dibs type of scenario, but not necessarily something that's just going to shoot straight up in the air. After all, with the Federal Reserve cutting interest rates by 50 basis points, while that does inject a lot of liquidity into the system, it also injects a lot of questions. Is the U.S. economy slowing down much quicker than they think? Or perhaps even let on?

Top Forex Brokers

If Things Get Bad

If that's the case, in a bit of irony, you'll probably see the US dollar strengthen as people run for safety. These things generally play out over the course of a couple of weeks when they happen, and therefore I would be a bit cautious. It's not necessarily that you can't be a buyer of dips, it's just that you can't bet your whole account on it.

Position sizing will be crucial, as the markets could be very noisy, and therefore you don’t necessarily know where to put a significant amount of trading capital.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.